Accounting

Anthropology

Archaeology

Art History

Banking

Biology & Life Science

Business

Business Communication

Business Development

Business Ethics

Business Law

Chemistry

Communication

Computer Science

Counseling

Criminal Law

Curriculum & Instruction

Design

Earth Science

Economic

Education

Engineering

Finance

History & Theory

Humanities

Human Resource

International Business

Investments & Securities

Journalism

Law

Management

Marketing

Medicine

Medicine & Health Science

Nursing

Philosophy

Physic

Psychology

Real Estate

Science

Social Science

Sociology

Special Education

Speech

Visual Arts

Question

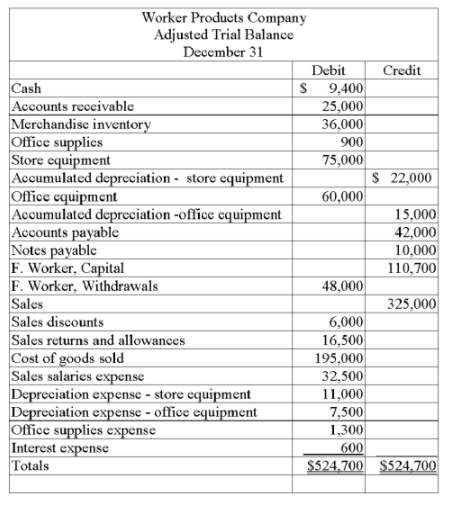

From the adjusted trial balance for Worker Products Company given below, prepare the necessary closing entries.

Answer

This answer is hidden. It contains 24 characters.

Related questions

Q:

Kramer Corporation had the following long-term investment transactions. repare the journal entries Kramer Corporation should record for these transactions and events.

Q:

Acadia had no investments prior to the current year. It had the following transactions involving available-for-sale and held-to-maturity securities during the year. The stock purchases are considered short-term available-for-sale securities. Prepare journal entries to record the transactions and events associated with the investment purchases.

Q:

Halam Company had the following transactions relating to investments in trading securities during the year. Prepare the required general journal entries for these transactions.

Q:

General standards of comparisons include the 2:1 level for the current ratio and 1:1 level for the acid-test ratio.

Q:

Financial reporting includes not only general purpose financial statements, but also information from SEC filings, press releases, shareholders' meetings, forecasts, management letters, auditor's reports, and Webcasts.

Q:

______________________ ratios include the price-earnings ratio and dividend yield.

Q:

The statement of cash flows reports and proves the net change in cash for a reporting period.

Q:

When preparing the operating section of the statement of cash flows using the indirect method, noncash expenses are _____________ net income.

Q:

Most managers stress the importance of understanding and predicting cash flows for business decisions.

Q:

Conversion of preferred stock to common stock is disclosed in the financing section of the statement of cash flows.

Q:

The full disclosure principle requires that noncash investing and financing activities be disclosed in the financial statements.

Q:

Internal users of the statement of cash flows often use cash flow information to plan day-to-day operating activities and make long-term investment and financing decisions.

Q:

On January 1, 2011, Freder Corporation purchased 7,500 shares of SportTech as a long-term investment for a total of $235,000. The 7,500 shares represent 30% of the outstanding (25,000) shares of SportTech. Prepare the journal entries for Freder to record the following transactions and events:

Q:

Long-term investments:

A. Are current assets.

B. Include funds earmarked for a special purpose such as bond sinking funds.

C. Must be readily convertible to cash.

D. Are expected to be converted into cash within one year.

E. Include only equity securities.

Q:

Refer to the following selected financial information from Fennie's, LLC. Compute the company's days' sales in inventory for Year 2. A. 43.9.B. 42.3.C. 46.2.D. 80.0.E. 113.3.

Q:

A company had a market price of $37.50 per share, earnings per share of $1.25, and dividends per share of $0.40. Its price-earnings ratio equals:

A. 3.1.

B. 30.0.

C. 93.8.

D. 32.0.

E. 3.3.

Q:

A bond sells at a discount when the:

A. Contract rate is above the market rate.

B. Contract rate is equal to the market rate.

C. Contract rate is below the market rate.

D. Bond has a short-term life.

E. Bond pays interest only once a year.

Q:

Collateral agreements for a note or bond can:

A. Lower the risk in comparison with unsecured debt.

B. Increase the risk in comparison with unsecured debt.

C. Have no effect on risk.

D. Reduce the issuer's assets.

E. Increase total cost for the borrower.

Q:

Which of the following statements is True?

A. Interest on bonds is tax deductible.

B. Interest on bonds is not tax deductible.

C. Dividends to stockholders are tax deductible.

D. Bonds do not have to be repaid.

E. Bonds always increase return on equity.

Q:

All of the following statements regarding leases are True except:

A. For a capital lease the lessee records the leased item as its own asset.

B. For a capital lease the lessee depreciates the asset acquired under the lease, but for an operating lease the lessee does not.

C. Capital leases create a long-term liability on the balance sheet, but operating leases do not.

D. Capital leases do not transfer ownership of the asset under the lease, but operating leases often do.

E. For an operating lease the lessee reports the lease payments as rental expense.

Q:

A company must repay the bank a single payment of $10,000 cash in 3 years for a loan it entered into. The loan is at 8% interest compounded annually. The present value factor for 3 years at 8% is 0.7938. The present value of the loan is:

A. $10,000.

B. $12,400.

C. $7,938.

D. $9,200.

E. $7,600.

Q:

Short-term investments in held-to-maturity debt securities are accounted for using the:

A. Fair value method with fair value adjustment to income.

B. Fair value method with fair value adjustment to equity.

C. Cost method with amortization.

D. Cost method without amortization.

E. Equity method.

Q:

At the end of the accounting period, the owners of debt securities:

A. Must report the dividend income accrued on the debt securities.

B. Must retire the debt.

C. Must record a gain or loss on the interest income earned.

D. Must record a gain or loss on the dividend income earned.

E. Must record any interest earned on the debt securities.

Q:

At acquisition, debt securities are:

A. Recorded at their cost, plus total interest that will be paid over the life of the security.

B. Recorded at the amount of interest that will be paid over the life of the security.

C. Recorded at cost.

D. Not recorded, because no interest is due yet.

E. Recorded at cost plus the amount of dividend income to be received.

Q:

Graphical analysis of the balance sheet can be useful in assessing sources of financing.

Q:

A trend percent, or index number, is calculated by dividing the analysis period amount by the base period amount and multiplying the result by 100.

Q:

A financial statement analysis report helps to reduce uncertainty in business decisions through a rigorous and sound evaluation.

Q:

A general journal is:

A. A ledger in which amounts are posted from a balance column account.

B. Not required if T-accounts are used.

C. A complete record of any transaction and the place from which transaction amounts are posted to the ledger accounts.

D. Not necessary in electronic accounting systems.

E. A book of final entry because financial statements are prepared from it.

Q:

A balance column ledger account is:

A. An account entered on the balance sheet.

B. An account with debit and credit columns for posting entries and another column for showing the balance of the account after each entry is posted.

C. Another name for the withdrawals account.

D. An account used to record the transfers of assets from a business to its owner.

E. A simple form of account that is widely used in accounting to illustrate the debits and credits required in recording a transaction.

Q:

An asset created by prepayment of an expense is:

A. Recorded as a debit to an unearned revenue account.

B. Recorded as a debit to a prepaid expense account.

C. Recorded as a credit to an unearned revenue account.

D. Recorded as a credit to a prepaid expense account.

E. Not recorded in the accounting records until the earnings process is complete.