Accounting

Anthropology

Archaeology

Art History

Banking

Biology & Life Science

Business

Business Communication

Business Development

Business Ethics

Business Law

Chemistry

Communication

Computer Science

Counseling

Criminal Law

Curriculum & Instruction

Design

Earth Science

Economic

Education

Engineering

Finance

History & Theory

Humanities

Human Resource

International Business

Investments & Securities

Journalism

Law

Management

Marketing

Medicine

Medicine & Health Science

Nursing

Philosophy

Physic

Psychology

Real Estate

Science

Social Science

Sociology

Special Education

Speech

Visual Arts

Question

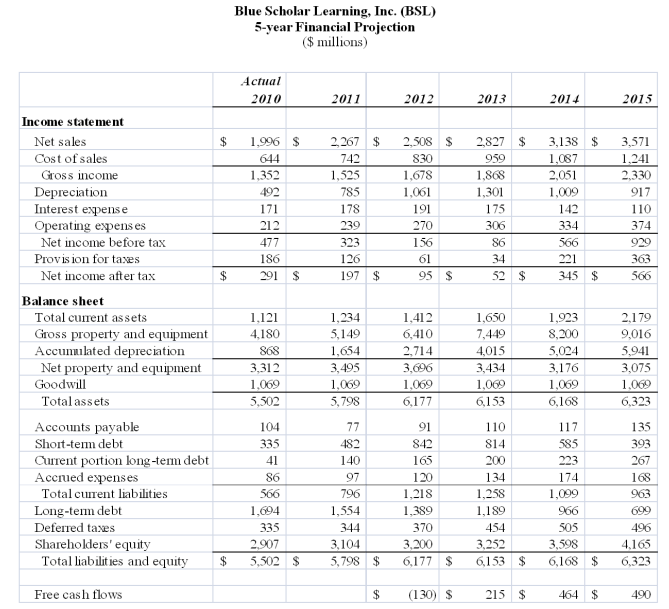

In March of 2011, Macklemore Corp. considered an acquisition of Blue Scholar Learning, Inc. (BSL), a privately-held educational software firm. As a first step in deciding what price to bid for BSL, Macklemore's CFO, Ryan Lewis, has prepared a five-year financial projection for the company assuming the acquisition takes place. Use this projection and BSL's 2010 actual financial figures to answer the questions below.

Assume that at year-end 2015 the company's equity is worth 15 times earnings after tax and its debt is worth book value. Macklemore's WACC is 8.0 percent. BSL's WACC is 11.5 percent, and the average of the two companies' WACCs, weighted by sales, is 8.2 percent. What is the maximum acquisition price (in $ millions) Macklemore should pay to acquire BSL's equity at the end of 2010?

A. $3,484.68

B. $4,723.26

C. $4,938.06

D. $5,554.68

E. $6,343.26

F. None of the above.

Answer

This answer is hidden. It contains 929 characters.

Related questions

Q:

The following table presents forecasted financial and other information for Scott's Miracle-Gro Co.: What is an appropriate estimate of Scott's terminal value as of the end of 2014, using a warranted multiple of free cash flow as your estimate?A. $155 millionB. $2,898.5 millionC. $3,007.0 millionD. $4,365.0 millionE. $7,042.2 millionF. None of the above.

Q:

The weighted average cost of capital for a firm is the:A. discount rate which the firm should apply to all of the projects it undertakes.B. rate of return a firm must earn on its existing assets to maintain the current value of its stock.C. coupon rate the firm should expect to pay on its next bond issue.D. minimum discount rate the firm should require on any new project.E. rate of return shareholders should expect to earn on their investment in this firm.F. None of the above.

Q:

Which of the following statements are correct concerning diversifiable, or unsystematic, risks?

I. Diversifiable risks can be largely eliminated by investing in thirty unrelated securities.

II. There is no reward for accepting diversifiable risks.

III. Diversifiable risks are generally associated with an individual firm or industry.

IV. Beta measures diversifiable risk.

A. I and III only

B. II and IV only

C. I and IV only

D. I, II, and III only

E. I, II, III, and IV

F. None of the above.

Q:

Unsystematic risk:

A. can be effectively eliminated by portfolio diversification.

B. is compensated for by the risk premium.

C. is measured by beta.

D. is measured by standard deviation.

E. is related to the overall economy.

F. None of the above.

Q:

Total risk is measured by _____ and systematic risk is measured by ____.

A. beta; alpha

B. beta; standard deviation

C. WACC; beta

D. standard deviation; beta

E. standard deviation; variance

F. None of the above.

Q:

When making a capital budgeting decision, which of the following is/are NOT relevant?

I. The size of a cash flow.

II. The risk of a cash flow.

III. The accounting earnings from a cash flow.

IV. The timing of a cash flow.

A. I only

B. II only

C. III only

D. II and III only

E. III and IV only

F. They are all relevant.

Q:

Which of the following statements related to the internal rate of return (IRR) are correct?

I. The IRR is the discount rate at which an investment's NPV equals zero.

II. An investment should be undertaken if the discount rate exceeds the IRR.

III. The IRR tends to be used more than net present value simply because its results are easier to comprehend.

IV. The IRR is the best tool available for deciding between mutually exclusive investments.

A. I and II only

B. I and III only

C. II and III only

D. I, II, and IV only

E. I, II, III, and IV

F. None of the above.

Q:

Which of the following figures of merit does not directly take into consideration the time value of money?

I. Payback period

II. Internal rate of return

III. Net present value (NPV)

IV. Accounting rate of return

A. IV only

B. I & III only

C. II & III only

D. I & II only

E. I & IV only

F. I, II, III, and IV

Q:

Calculate Squamish's times burden covered ratio for the next year assuming annual sinking fund payments on the new debt will equal $8 million.A. 1.01B. 1.08C. 1.38D. 1.49E. 1.95F. None of the above.

Q:

Which of the following factors favor the issuance of debt in the financing decision?

I. Market signaling

II. Distress costs

III. Management incentives

IV. Financial flexibility

A. I and II only

B. I and III only

C. II and IV only

D. I, II, and III only

E. I, II, and IV only

F. None of the above.

Q:

Homemade leverage is:

A. the incurrence of debt by a corporation in order to pay dividends to shareholders.

B. the exclusive use of debt to fund a corporate expansion project.

C. the borrowing or lending of money by individual shareholders as a means of adjusting their level of financial leverage.

D. best defined as an increase in a firm's debt-equity ratio.

E. the term used to describe the capital structure of a levered firm.

F. None of the above.

Q:

You believe interest rates will soon fall.

a. Would you rather own a three-year, 6 percent coupon, fixed-rate bond or an equivalent-risk, three-year, floating-rate bond currently paying 6 percent interest?

b. Would your answer to (a) change if you were contemplating issuing a bond rather than owning one? If so, how?

c. Would your answer to (a) change if, as an investor, you believed interest rates would soon rise? If so, why?

Q:

Depreciation expense:

A. reduces both taxes and net income.

B. increases the net fixed assets as shown on the balance sheet.

C. reduces both the net fixed assets and the costs of a firm.

D. is a noncash item that increases net income.

E. decreases current assets, net income, and operating cash flows.

Q:

Which one of the following is the financial statement that summarizes changes in the company's cash balance over a period of time?

A. income statement

B. balance sheet

C. cash flow statement

D. shareholders' equity statement

E. market value statement

Q:

Which one of the following is the financial statement that summarizes a firm's revenue and expenses over a period of time?

A. income statement

B. balance sheet

C. cash flow statement

D. sources and uses statement

E. market value statement

Q:

Which one of the following is the financial statement that shows a financial snapshot, taken at a point in time, of all the assets the company owns and all the claims against those assets?

A. income statement

B. creditor's statement

C. balance sheet

D. cash flow statement

E. sources and uses statement

Q:

Which of the following statements are true?

I. Underwriters help private companies access public stock markets through IPOs.

II. Shelf registrations and private placements are examples of seasoned security issues.

III. Issue costs for debt are typically greater than issue costs for equity.

IV. Private equity financing is a common source of financing for startup firms.

A. I and II only

B. I and III only

C. I, II, and IV only

D. I, III, and IV only

E. I, II, III, and IV

F. None of the above.

Q:

Law Dog paid its first dividends in 2004. As an analyst, assess the company's decision to pay dividends.

Q:

Use the information from Boss's annual financial statements. What is the difference between the sustainable growth and actual growth rates for 2011?A. - 11.40%B. - 7.09%C. -3.04%D. 5.47%E. 13.98%F. 21.40%

Q:

The sustainable growth rate of a firm is best described as the:

A. minimum growth rate achievable assuming a 100 percent retention ratio.

B. minimum growth rate achievable if the firm maintains a constant equity multiplier.

C. maximum growth rate achievable excluding external financing of any kind.

D. maximum growth rate achievable excluding any external equity financing while maintaining a constant debt-equity ratio.

E. maximum growth rate achievable with unlimited debt financing.

F. None of the above.

Q:

Which one of the following correctly defines the retention ratio?

A. one plus the dividend payout ratio

B. additions to retained earnings divided by net income

C. additions to retained earnings divided by dividends paid

D. net income minus additions to retained earnings

E. net income minus cash dividends

F. None of the above.

Q:

The retention ratio is:

A. equal to net income divided by the change in total equity.

B. the percentage of net income available to the firm to fund future growth.

C. equal to one minus the asset turnover ratio.

D. the change in retained earnings divided by the dividends paid.

E. the dollar increase in net income divided by the dollar increase in sales.

F. None of the above.

Q:

Preston Fencing Company's sales, half of which are for cash and the other half sold on credit, over the past three months were: a. Estimate Preston's cash receipts in October if the company's collection period is 30 days.b. Estimate Preston's cash receipts in October if the company's collection period is 45 days.c. What would be the October balance of accounts receivable for Preston Fencing if the company's collection period is 30 days? 45 days?

Q:

Which of the following are viable techniques to cope with the uncertainty inherent in realistic financial projections?

I. Simulation

II. Ad hoc adjustments

III. Scenario analysis

IV. Sensitivity analysis

A. II and IV only

B. III and IV only

C. II, III, and IV only

D. I, II, and III only

E. I, III, and IV only

F. I, II, III, and IV

Q:

Selected financial data for Link, Inc. follows: ($ in thousands)The current ratio at the end of 2012 is:A. 10.21B. 2.31C. 2.76D. 10.30E. None of the above.

Q:

Breakers Bay Inc. has succeeded in increasing the amount of goods it sells while holding the amount of inventory on hand at a constant level. Assume that both the cost per unit and the selling price per unit also remained constant. All else held constant, how will this accomplishment be reflected in the firm's financial ratios?

A. decrease in the fixed asset turnover rate

B. decrease in the financial leverage ratio

C. increase in the inventory turnover rate

D. increase in the day's sales in inventory

E. no change in the total asset turnover rate

Q:

Which one of the following ratios identifies the amount of assets a firm needs in order to generate $1 in sales?

A. current ratio

B. debt-to-equity

C. retention

D. asset turnover

E. return on assets

Q:

Below is a recent income statement for Gatlin Camera:

Q:

Consider the following premerger information about a bidding firm (Buyitall Inc.) and a target firm (Tarjay Corp.). Assume that neither firm has any debt outstanding. Buyitall has estimated that the present value of any enhancements that Buyitall expects from acquiring Tarjay is $2,600. What is the NPV of the merger assuming that Tarjay is willing to be acquired for $28 per share in cash?A. $400B. $600C. $1,800D. $2,200E. $2,600F. None of the above.

Q:

Ginormous Oil entered into an agreement to purchase all of the outstanding shares of Slick Company for $60 per share. The number of outstanding shares at the time of the announcement was 82 million. The book value of liabilities on the balance sheet of Slick Co. was $1.46 billion. Immediately prior to the Ginormous Oil bid, the shares of Slick Co. traded at $33 per share. What value did Ginormous Oil place on the control of Slick Co.?

A. $2.21 billion

B. $2.71 billion

C. $4.17 billion

D. $6.38 billion

E. None of the above.