Accounting

Anthropology

Archaeology

Art History

Banking

Biology & Life Science

Business

Business Communication

Business Development

Business Ethics

Business Law

Chemistry

Communication

Computer Science

Counseling

Criminal Law

Curriculum & Instruction

Design

Earth Science

Economic

Education

Engineering

Finance

History & Theory

Humanities

Human Resource

International Business

Investments & Securities

Journalism

Law

Management

Marketing

Medicine

Medicine & Health Science

Nursing

Philosophy

Physic

Psychology

Real Estate

Science

Social Science

Sociology

Special Education

Speech

Visual Arts

Question

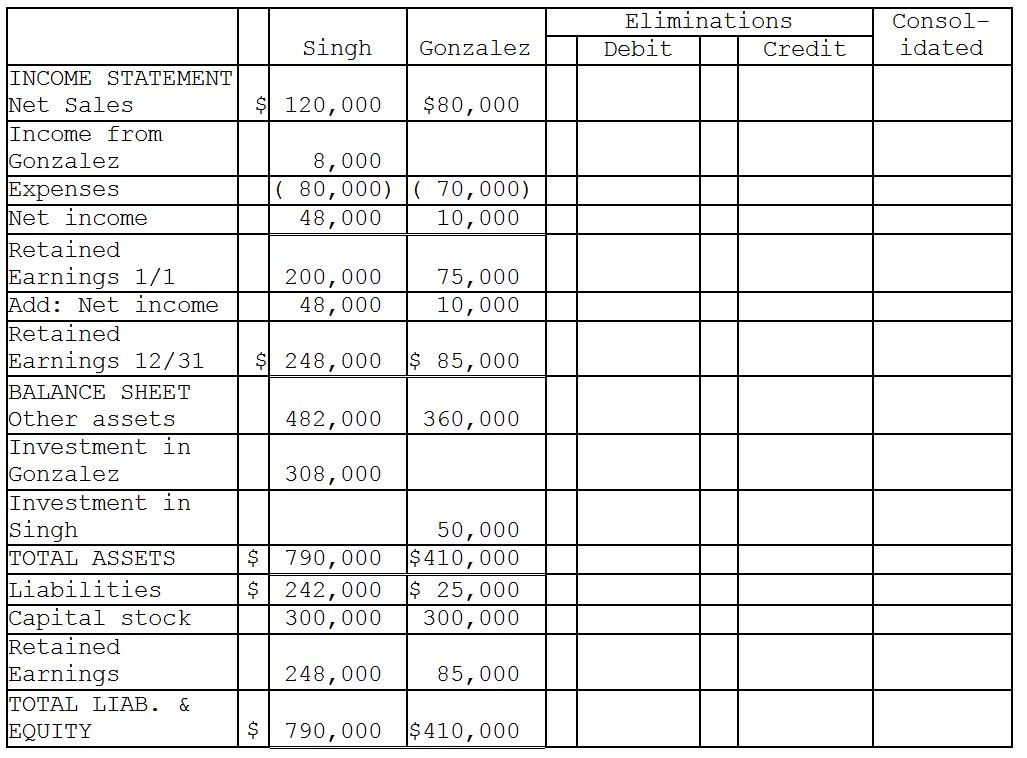

On January 1, 2011, Singh Company acquired an 80 percent interest in Gonzalez Company for $300,000. On January 1, 2011, Gonzalez's total stockholders' equity was $375,000. The fair value and book value of Gonzalez's individual assets and liabilities were equal.

On January 2, 2011, Gonzalez Company acquired a 10 percent interest in Singh Company for $50,000. On January 2, 2011, Singh's total stockholders' equity was $500,000. The fair value and book value of Singh's individual assets and liabilities were equal.

For the year ending December 31, 2011, the following data is available:

Net income Dividends

Singh Company $40,000 $0

Gonzalez Company $10,000 $0

The treasury stock method is used to account for the mutual stock holdings between Singh and Gonzalez. The separate net incomes do not include investment income. A partial consolidating worksheet is below.

Required:

Prepare the elimination entries for the year ending December 31, 2011.

Do not enter them onto the worksheet. Instead, list them below.

Answer

This answer is hidden. It contains 256 characters.

Related questions

Q:

Oscar Lloyd is serving as the executor for the estate of Dixie Cooper, who passed away on January 28, 2011, at the age of 98. Dixie's estate consisted of Treasury bonds with a maturity value and fair market value of $1,400,000, $4,000 in her checking account, and $50,000 in a Certificate of Deposit with First State Bank of Springfield. Total accrued interest at the time of death was $44,000, made up of $2,000 from the CD and $42,000 from the bonds. Dixie left a valid will, which provided that most of her estate would be inherited by her two nephews, Jimmy Johns and Joey Johns. In addition, Dixie provided that $200,000 be transferred to a trust account for her faithful cats, Petra and Hobbes. Income from the trust would be used to care for Hobbes and Petra. Upon their passing, the remaining funds would then transfer to Operation Kindness, an organization that cares for cats and dogs. Mr. Lloyd will also serve as the fiduciary for the trust. He has determined that no state or federal inheritance taxes are due. The limited estate income is also free from any federal or state income tax. The following transactions occurred during February. 1. On February 3, Oscar sold the treasury bonds for $1,460,000. $1,400,000 was for the fair market value of the bonds, $42,000 was for interest accrued to the time of Dixie's death, and the remaining $18,000 was for accrued interest since Dixie's death. Estate income will be used to pay final medical expenses, and if anything is left, funeral expenses. 2. On February 11, Oscar issued a check to pay Dixie's final medical expenses of $11,900. 3. On February 15, Oscar received a check in the amount of $52,000 from First State Bank of Springfield. It is the maturity value and interest from a certificate of deposit in the amount of $50,000. The CD matured on January 22, 2011. 4. In Dixie's will, she wanted to give $150,000 to the American Humane Society. After examining the assets, Oscar determined that the estate's assets will adequately cover all expenses and specific devises, so on February 3, he issued a check to the organization for $150,000. 5. On February 18, Oscar transferred $200,000 to a trust account at First State Bank to fund the trust, to care for the cats. 6. On February 25, Oscar issued a check to pay Dixie's funeral expenses of $9,800. 7. On February 26, Oscar paid himself the $4,000 executor's fee specified in Dixie's will. 8. On February 28, Oscar finalized the estate and transferred the balance of the estate's assets equally between Dixie's nephews, Jimmy Johns and Joey Johns. Required:1. Prepare an inventory of estate assets at the time of Dixie's death and record the necessary journal entries to create the estate.2. Prepare journal entries to record the estate's transactions during February.

Q:

On December 31, 2011, Potter Corporation has the following stockholders' equity:Common stock, $10 par $200,000Retained earnings 100,000Total stockholders' equity $300,000On January 1, 2012, Potter Corporation declared and issued a 10% stock dividend when the market price per share was $50.On January 2, 2012, Corrao Corporation purchased an 80% interest in Potter Corporation for $250,000 on the open market. On January 2, 2012, the fair value of Potter's individual assets and liabilities was equal to book value. Any excess cost over book value is attributed to goodwill.Required:Prepare the journal entry(ies) for Potter Corporation on January 1, 2012.Prepare the journal entry(ies) for Corrao Corporation on January 2, 2012.Prepare the elimination entry(ies) for consolidating work papers on January 2, 2012.Prepare the elimination entry(ies) for consolidating work papers on January 2, 2012 if the 10% stock dividend is not declared and issued on January 1, 2012.

Q:

Plover Corporation acquired 80% of Sink Inc. equity on January 1, 2010, when the book values of Sink's assets and liabilities were equal to their fair values. The cost of the investment was equal to 80% of the book value of Sink's net assets.

Plover separate income (excluding Sink) was $1,800,000, $1,700,000 and $1,900,000 in 2010, 2011 and 2012 respectively. Plover sold inventory to Sink during 2010 at a gross profit of $48,000 and one quarter remained at Sink at the end of the year. The remaining 25 percent was sold in 2011. At the end of 2011, Plover has $25,000 of inventory received from Sink from a sale of $100,000 which cost Sink $80,000. There are no unrealized profits in the inventory of Plover or Sink at the end of 2012. Plover uses the equity method in its separate books. Select financial information for Sink follows:

2010 2011 2012

Sales $790,000 $840,000 $940,000

Cost of Sales (420,000) (440,000) (500,000)

Gross Profit 370,000 400,000 440,000

Operating Expenses (300,000) (320,000) (350,000)

Net Income $ 70,000 $ 80,000 $ 90,000

Required:

Prepare a schedule to determine the controlling interest share of the consolidated net income for 2010, 2011, and 2012.

Q:

Peel Corporation acquired a 80% interest in Sitt Corporation at a cost equal to 80% of the book value of Sitt several years ago. At the time of purchase, the fair value and book value of Sitt's assets and liabilities were equal. Sitt purchases its entire inventory from Peel at 150% of Peel's cost. During 2011, Peel sold $190,000 of merchandise to Sitt. Sitt's beginning and ending inventories for 2011 were $72,000 and $66,000, respectively. Income statement information for both companies for 2011 is as follows:

Peel Sitt

Sales Revenue $820,000 $440,000

Investment income from Sitt 146,000

Cost of Goods Sold (460,000) (165,000)

Expenses (120,000) (95,000)

Net Income $386,000 $180,000

Required:

Prepare a consolidated income statement for Peel Corporation and Subsidiary for 2011.

Q:

Pfeifer Corporation acquired an 80% interest in Stern Corporation several years ago when the book values and fair values of Stern's assets and liabilities were equal. At the time of acquisition, the cost of the 80% interest was equal to 80% of the book value of Stern's net assets. Separate company income statements for Pfeifer and Stern for the year ended December 31, 2011 are summarized as follows:

Pfeifer Stern

Sales Revenue $1,000,000 $600,000

Investment income from Stern 85,000

Cost of Goods Sold (600,000) (300,000)

Expenses (200,000) (200,000)

Net Income $285,000 $100,000

During 2010, Pfeifer sold merchandise that cost $120,000 to Stern for $180,000. Half of this merchandise remained in Stern's inventory at December 31, 2010. During 2011, Pfeifer sold merchandise that cost $150,000 to Stern for $225,000. One-third of this merchandise remained in Stern's December 31, 2011 inventory.

Required:

Prepare a consolidated income statement for Pfeifer Corporation and Subsidiary for 2011.

Q:

Pirate Transport bought 80% of the outstanding voting stock of Seaways Shipping at book value several years ago. (At the time of purchase, the fair value and book value of Seaways' net assets were equal.) Pirate sells merchandise to Seaways at 120% above Pirate's cost. Intercompany sales from Pirate to Seaways for 2012 were $450,000. Unrealized profits in Seaways' December 31, 2011 inventory and December 31, 2012 inventory were $17,000 and $15,000, respectively. Seaways reported net income of $750,000 for 2012.

Required:

1. Determine Pirate's income from Seaways for 2012.

2. In General Journal format, prepare consolidation working paper entries at December 31, 2012 to eliminate the effects of the intercompany inventory sales assuming the perpetual inventory method is used.

Q:

Penguin Corporation acquired a 60% interest in Squid Corporation on January 1, 2012, at a cost equal to 60% of the book value of Squid's net assets. At the time of the acquisition, the book values of Squid's assets and liabilities were equal to the fair values. Squid reports net income of $880,000 for 2012. Penguin regularly sells merchandise to Squid at 120% of Penguin's cost. The intercompany sales information for 2012 is as follows:

Intercompany sales at selling price $672,000

Sales value of merchandise unsold by Squid $132,000

Required:

1. Determine the unrealized profit in Squid's inventory at December 31, 2012.

2. Compute Penquin's income from Squid for 2012.

Q:

Shalles Corporation, a 80%-owned subsidiary of Pani Corporation, sold inventory items to its parent at a $48,000 profit in 2012. Pani resold one-third of this inventory to outside entities. Shalles reported net income of $200,000 for 2012. Noncontrolling interest share of consolidated net income that will appear in the income statement for 2012 is

A) $30,400.

B) $32,000.

C) $33,600.

D) $40,000.

Q:

Use the following information to answer the question(s) below.Pouch Corporation acquired an 80% interest in Shenley Corporation on January 1, 2012, when the book values of Shenley's assets and liabilities were equal to their fair values. The cost of the 80% interest was equal to 80% of the book value of Shenley's net assets. During 2012, Pouch sold merchandise that cost $70,000 to Shenley for $86,000. On December 31, 2012, three-fourths of the merchandise acquired from Pouch remained in Shenley's inventory. Separate incomes (investment income not included) of the two companies are as follows:Pouch ShenleySales Revenue $180,000 $160,000Cost of Goods Sold 120,000 90,000Operating Expenses 17,000 21,000Separate incomes $ 43,000 $ 49,000Swamp Co., a 55%-owned subsidiary of Pond Inc., made the following entry to record a sale of merchandise to Pond:Accounts Receivable 40,000Sales Revenue 40,000All Swamp sales are at 125% of cost. One-fourth of this merchandise remained in the Pond's inventory at year-end. A working paper entry to eliminate unrealized profits from consolidated inventory would include a credit to Inventory in the amount ofA) $2,000.B) $2,500.C) $8,000.D) $10,000.

Q:

If the intercompany sale was an upstream sale, the total amount of consolidated cost of goods sold for 2012 will be

A) $300,000.

B) $430,000.

C) $470,000.

D) $477,000.

Q:

Pull Incorporated and Shove Company reported summarized balance sheets as shown below, on December 31, 2011.

Pull Shove

Current assets $420,000 $210,000

Noncurrent assets 670,000 430,000

Total assets $1,090,000 $640,000

Current liabilities $230,000 $50,000

Long-term debt 350,000 150 000

Stockholders' equity 510,000 440,000

Total liabilities and equities $1,090,000 $640,000

On January 1, 2012, Pull purchased 70% of the outstanding capital stock of Shove for $392,000, of which $92,000 was paid in cash, and $300,000 was borrowed from their bank. The debt is to be repaid in 10 annual installments beginning on December 31, 2012, with each payment consisting of $30,000 principal, plus accrued interest.

The excess fair value of Shove Company over the underlying book value is allocated to inventory (60 percent) and to goodwill (40 percent).

Required: Calculate the balance in each of the following accounts, on the consolidated balance sheet, immediately following the acquisition.

a. Current assets

b. Noncurrent assets

c. Current liabilities

d. Long-term debt

e. Stockholders' equity

Q:

Which of the following conditions would not indicate that two business segments should be classified as a single operating segment?A) They have similar amounts of intersegment revenues or expenses.B) They have a similar distribution method for products.C) They have similar production processes.D) They have similar products or services.

Q:

Note to Instructor: This exam item is similar to Exercise 3 except that the exchange rates have been changed and the temporal method is used instead of the current rate method.The Polka Corporation, a U.S. corporation, formed a British subsidiary on January 1, 2011 by investing 550,000 British pounds () in exchange for all of the subsidiary's no-par common stock. The British subsidiary, Stripe Corporation, purchased real property on April 1, 2011 at a cost of 500,000, with 100,000 allocated to land and 400,000 allocated to the building. The building is depreciated over a 40-year estimated useful life on a straight-line basis with no salvage value. The U.S. dollar is Stripe's functional currency, but it keeps its records in pounds. The British economy does not experience high rates of inflation. Exchange rates for the pound on various dates are:January 01, 2011 = 1 = $1.60April 01, 2011 = 1 = $1.62December 31, 2011 = 1 = $1.652011 average rate = 1 = $1.64Stripe's adjusted trial balance is presented below for the year ended December 31, 2011.In PoundsDebits:Cash 200,000Accounts receivable 72,000Notes receivable 99,000Building 400,000Land 100,000Depreciation expense 7,500Other expenses 115,000Salary expense 208,000Total debits 1,201,500CreditsAccumulated depreciation 7,500Accounts payable 100,000Common stock 550,000Retained earnings 0Equity adjustment 0Sales revenue 544,000Total credits 1,201,500Required: Prepare Stripe's:1. Remeasurement working papers;2. Remeasured income statement; and3. Remeasured balance sheet.

Q:

Note to Instructor: This exam item is a continuation of Exercise 5 and proceeds forward with Stripe's second year of operations.Stripe Corporation, a British subsidiary of Polka Corporation (a U.S. company) was formed by Polka on January 1, 2011 in exchange for all of the subsidiary's common stock. Stripe has now ended its second year of operations on December 31, 2012. Relevant exchange rates are:January 01, 2011 = 1 = $1.60April 01, 2011 = 1 = $1.62December 31, 2012 = 1 = $1.572012 average rate = 1 = $1.56Stripe's adjusted trial balance is presented below for the calendar year 2012.In PoundsDebits:Cash 172,000Accounts receivable 308,000Notes receivable 98,000Building 400,000Land 100,000Depreciation expense 10,000Other expenses 117,000Salary expense 376,000Total debits 1,581,000CreditsAccumulated depreciation 17,500Accounts payable 200,000Common stock 550,000Retained earnings 213,500Sales revenue 600,000Total credits 1,581,000Required: Prepare Stripe's:1. Remeasurement working papers;2. Remeasured income statement; and3. Remeasured balance sheet.

Q:

Pan Corporation, a U.S. company, formed a British subsidiary on January 1, 2012 by investing 450,000 British pounds () in exchange for all of the subsidiary's no-par common stock. The British subsidiary, Skillet Corporation, purchased real property on April 1, 2012 at a cost of 500,000, with 100,000 allocated to land and 400,000 allocated to a building. The building is depreciated over a 40-year estimated useful life on a straight-line basis with no salvage value. The British pound is Skillet's functional currency and its reporting currency. The British economy does not have high rates of inflation. Exchange rates for the pound on various dates were:January 01, 2012 = 1 = $1.60April 01, 2012 = 1 = $1.61December 31, 2012 = 1 = $1.682012 average rate = 1 = $1.66Skillet's adjusted trial balance is presented below for the year ended December 31, 2012.In PoundsDebits:Cash 220,000Accounts receivable 52,000Inventory 59,000Building 400,000Land 100,000Depreciation expense 7,500Other expenses 110,000Cost of goods sold 220,000Total debits 1,168,500CreditsAccumulated depreciation 7,500Accounts payable 111,000Common stock 450,000Retained earnings 0Equity adjustment 0Sales revenue 600,000Total credits 1,168,500Required: Prepare Skillet's:1. Translation working papers;2. Translated income statement; and3. Translated balance sheet.

Q:

Mason Dixon dies on November 30, 2011, leaving a valid will. The will reads as follows:"I leave my boat to my son, George. I leave my automobile to my daughter, Georgia. I leave the income on my estate to be divided equally between George and Georgia. Estate expenses are to be paid from principal, not estate income. All other property, I leave to a trust to care for my wife, Gladys. Any remaining property at the time of her death is to be transferred into a trust to pay college education expenses of my grandchildren until such time as it is used up. I name my wife, Gladys, as executrix of my estate."Gladys prepares an estate inventory for all assets discovered and files the appropriate notice to potential creditors on December 15.Cash $ 90,000Investments 1,200,000Interest Receivable 2,000Life Insurance Receivable 500,000Residence 180,000Automobile 20,000Boat 70,000Total $2,062,000A check for interest is received of $5,000, and estate liabilities (such as funeral expenses, administrative costs, and taxes) are settled for $20,000. The will is administered.Required:Prepare a charge-discharge statement for the estate of Mason Dixon on December 31, 2011. Assume the life insurance proceeds have not been paid out.

Q:

You are serving as the executor for the estate of Dr. Mary Carlson. The following transactions occur during August 2011. Dr. Carlson died on July 30, 2011. 1. On August 6, you received interest of $3,000 on State of Colorado general revenue bonds. Interest of $1,600 was earned after the date of death. The balance was earned prior to death, and had been accrued. The bonds were included in the estate's initial inventory. The maturity value and fair market values of the bond are $100,000. 2. On August 11, you issued a check to pay a probate court fee of $1,120. 3. The estate included 10,000 shares of Dasher International's common stock, valued at $40 per share, which were properly included in the estate's initial inventory. On the date of her death, there were no outstanding dividends receivable. On August 14, you read that a dividend of $1 per share was declared. 4. In Mary's will, she wanted $100,000 given to the National Zoo.After examining the assets, you determined that the estate's assets will adequately cover all expenses and specific devises, so on August 23, you issued a check to the Zoo for $100,000. 5. On August 25, you issued a check to pay Mary's final medical expenses of $16,700. 6. On August 28, you received a check for $10,000 for the common stock dividends paid by Dash International. Required:Prepare the necessary journal entries for the above transactions. You may ignore any estate or income taxes.

Q:

Philiam Benedict dies on October 1, 2011, leaving his entire estate to his sole surviving niece, Muriel Finster. After all devise distributions and payments for estate expenses and liabilities, the fair value of Philiam's estate is $6,350,000.Required:Calculate the federal estate tax on Philiam's estate, assuming that federal estate taxes are paid at the 45% rate.

Q:

John Doe's will states that all assets he had should be transferred to a trust to cover living expenses for his spouse, who he feels will not be able to handle her own financial affairs without advice and supervision. Upon his spouse's passing, the trust will be converted to cash and distributed to their only daughter, Jane. The probate court already ruled on which assets could be excluded from the estate, and all tax issues were addressed, leaving the following inventory of assets from the estate: AssetCostFair ValueCash206,000206,000Certificates of Deposit250,000250,000Investments/Mutual Funds354,1162,780,500Residence34,000190,000Ocean front cottage78,000560,000Pepper mill collection2,0703,900 Required:Prepare the journal entry for the creation of the trust.

Q:

Avery died testate early in 2011. The following transactions occurred relating to Avery's estate.Avery's estate included bonds with a fair (market) value of $120,000. On the date of Avery's death, there was $2,000 of accrued but unpaid interest. Two months after Avery's death, a check arrived in the amount of $3,000, representing the normal semiannual interest payment.Avery's will stated a specific transfer to the Bird Sanctuary in the amount of $10,000. Avery's estate should be adequate to cover all obligations and devises, and the amount is paid.Funeral expenses amounted to $12,500.A bank statement is received from the First National Bank indicating a cash balance of $8,600. This bank account was not known or included on the estate inventory.Probate fees are paid to the court amounting to $900.Required:Prepare the journal entries for the listed transactions. Disregard the impact of estate and income taxes.

Q:

In reference to estate principal and income, which of the following statements is correct?A) A primary reason for dividing estate principal and estate income is that the beneficiaries are often different.B) In accounting for the decedent's estate, the receipts earned but not yet received at the date of death are considered estate income.C) After death, earnings from income-producing property owned at the time of death are considered estate principal.D) Expenses incurred after death to administer the estate are first charged against income earned after death.

Q:

Under the Uniform Probate Code, the personal representative must publish for what time period a notice in a newspaper of general circulation in the county in which the decedent resided?A) For one weekB) For two weeksC) For three weeksD) For five weeks

Q:

The executor or administrator of a will is required to prepare and file an inventory of property owned by the deceased within what time period?A) One month of appointmentB) Two months of appointmentC) Three months of appointmentD) 45 days of appointment

Q:

Which of the following is a gift of an object to a devisee?A) A general deviseB) A specific deviseC) A testamentary allocationD) An administrative devise

Q:

In reference to the probate process, which of the following statements is correct?A) The personal representative of the deceased can file a petition with the appropriate probate court requesting that an existing will be probated.B) The Uniform Probate Code varies from state to state.C) The Uniform Probate Code is applied to all wills found to be valid, and to wills found to be invalid in probate court.D) The Uniform Probate Code is applied to all wills found to be valid, but not to wills found to be invalid in probate court.

Q:

Which of the following phrases is frequently used to refer to estate or trust accounting?A) Non-profit accountingB) Testamentary accountingC) Fiduciary accountingD) All of the above phrases are used to refer to estate or trust accounting.

Q:

Prepare journal entries to record the following transactions for a private, not-for-profit university. 1. Tuition and fees assessed total $10,000,000, 80% of which was collected by year-end; tuition scholarships were granted for $1,300,000, and $650,000 was expected to be uncollectible. 2. Revenues collected from sales and services by the university bookstore were $1,450,000. 3. Salaries and wages paid were $5,600,000, $300,000 of which was for employees of the university bookstore. 4. Financial aid funds of $700,000 were received from the Pell Grant program; the funds were then disbursed to the appropriate students. 5. Contributions of $600,000 were received; $30,000 was restricted for the athletic department and the balance was unrestricted. An additional $70,000 was pledged to the athletic department by the alumni. 6. Athletic equipment was purchased with $42,000 previously set aside for that purpose.

Q:

Marshfield Hospital is a private, not-for-profit hospital. The following transactions occurred: 1. Unrestricted cash gifts that were received last year, but designated for use in the current year, totaled $180,000. The cash gifts were used in the current year in accordance with restrictions. 2. Unrestricted pledges of $800,000 were received. Ten percent of the pledges typically prove uncollectible. Additional cash contributions during the year totaled $300,000. 3. Gifts in kind were received that were sold at a silent auction for $23,000. The fair value of the donated gifts in kind could not be reasonably determined. 4. Expenses were incurred and paid as follows: Salary of doctor, $190,000; facility rental, $36,000; purchases of supplies, $8,000; and utility costs, $10,000. 5. Marketable securities with a fair value of $650,000 were received as a donation with a stipulation that the hospital use the funds to purchase suitable land for the hospital. Required:Prepare journal entries for the aforementioned transactions.

Q:

Carousel Clothes is a voluntary health and welfare organization that provides gently-used second-hand clothes to those in need. They had the following transactions in 2011.1. Cash gifts were received in the amount of $60,000, of which $13,000 had been pledged in the prior year. 2. Pledges made in the current year but not yet fulfilled amounted to $39,000. Ten percent of the pledges typically prove to be uncollectible. Pledges are made for 2011. 3. An office supply company donates office furniture to the VHWO. The fair value of the furniture is $40,000. No restrictions were placed on the donation. 4. The following expenses were incurred and paid: director's salary, $15,000; facility rental, $18,000; cleaning and repair costs for clothes, $29,000; and purchase of supplies consumed in tagging and distribution of clothes, $5,000. The director's salary is categorized as Support Services and the rest of the costs are Program Services. 5. Restricted pledges were received during the year for $450,000. The pledges are restricted for the construction of a new facility.Required:Prepare the journal entries for Carousel for 2011.

Q:

Albatross University, a not-for-profit, nongovernmental university, had the following transactions in 2011. 1. Tuition bills were sent amounting to $8,000,000, with 70% collected before the end of the fiscal year; tuition waivers were granted on the total amount of $400,000, and $220,000 was expected to be uncollectible. 2. Cafeteria sales, all cash, were $1,400,000. 3. Salaries and wages were paid amounting to $5,500,000, of which $370,000 was for cafeteria staff. 4. Long-term debt payments were made from general funds amounting to $800,000, of which $130,000 was for interest. 5. Equipment was purchased for the engineering department with funds previously set aside for that purpose, amounting to $180,000. Required:Prepare the journal entries for 2011 for Albatross University.