Accounting

Anthropology

Archaeology

Art History

Banking

Biology & Life Science

Business

Business Communication

Business Development

Business Ethics

Business Law

Chemistry

Communication

Computer Science

Counseling

Criminal Law

Curriculum & Instruction

Design

Earth Science

Economic

Education

Engineering

Finance

History & Theory

Humanities

Human Resource

International Business

Investments & Securities

Journalism

Law

Management

Marketing

Medicine

Medicine & Health Science

Nursing

Philosophy

Physic

Psychology

Real Estate

Science

Social Science

Sociology

Special Education

Speech

Visual Arts

Question

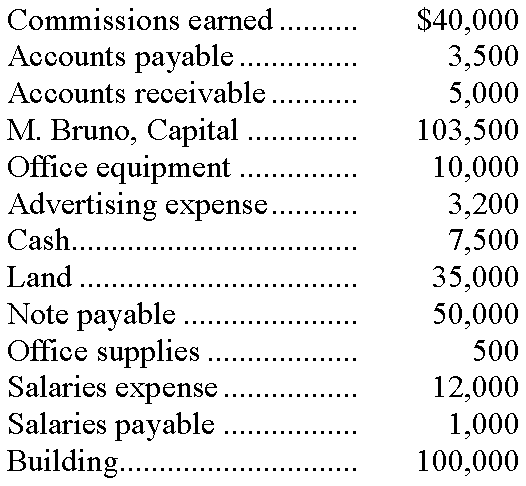

Prepare a December 31 balance sheet in proper form for Surety Insurance from the following items and amounts:

Answer

This answer is hidden. It contains 0 characters.

Related questions

Q:

Which of the following statements is incorrect?

A.Adjustments to prepaid expenses, depreciation, and unearned revenues involve previously recorded assets and liabilities.

B.Accrued expenses and accrued revenues involve assets and liabilities that had not previously been recorded.

C.Adjusting entries can be used to record both accrued expenses and accrued revenues.

D.Prepaid expenses, depreciation, and unearned revenues often require adjusting entries to record the effects of the passage of time.

E.Adjusting entries affect the cash account.

Q:

Adjusting entries are journal entries made at the end of an accounting period for the purpose of:

A.Updating liability and asset accounts to their proper balances.

B.Assigning revenues to the periods in which they are earned.

C.Assigning expenses to the periods in which they are incurred.

D.Assuring that financial statements reflect the revenues earned and the expenses incurred.

E.All of these.

Q:

The report form is considered to be the only correct format for the balance sheet.

Q:

Inventory shrinkage:

A.Refers to the loss of inventory.

B.Is determined by comparing a physical count of inventory with recorded inventory amounts.

C.Is recognized by debiting Cost of Goods Sold.

D.Can be caused by theft or deterioration.

E.All of these.

Q:

Merchandising companies must account for:

A.Sales.

B.Sales discounts.

C.Sales returns and allowances.

D.Cost of merchandise sold.

E.All of these.

Q:

Merchandise inventory:

A.Is reported on the balance sheet as a current asset.

B.Refers to products a company owns and intends to sell.

C.Can include the cost of shipping the goods to the store and making them ready for sale.

D.Does not appear on the balance sheet of a service company.

E.All of these.

Q:

A merchandising company:

A.Earns net income by buying and selling merchandise.

B.Receives fees only in exchange for services.

C.Earns profit from commissions only.

D.Earns profit from fares only.

E.Buys products from consumers.

Q:

Generally accepted accounting principles require companies to use one specific format for the financial statements.

Q:

Accounts unique to merchandising companies (versus service companies) include Merchandising Inventory, Sales, Sales Discounts, Sales Returns and Allowances, and Cost of Goods Sold.

Q:

Cash sales shorten the operating cycle for a merchandiser; credit purchases lengthen operating cycles.

Q:

The purpose of reversing entries is to:

A.simplify the recording of certain journal entries in the future.

B.correct an error made in a previous journal entry.

C.ensure that closing entries have been properly posted to the ledger accounts.

D.make certain that only permanent accounts are carried forward into the next accounting period.

E.complete a required step in the accounting cycle.

Q:

Which of the following statements is true?

A.Owner's capital must be closed each accounting period.

B.A post-closing trial balance should include only permanent accounts.

C.Information on the work sheet can be used in place of preparing financial statements.

D.By using a work sheet to prepare adjusting entries you need not post these entries to the ledger accounts.

E.Closing entries are only necessary if errors have been made.

Q:

Since the revenue recognition principle requires that revenues be earned, there are no unearned revenues in accrual accounting.

Q:

Adjusting entries are used to bring asset or liability accounts to their proper amount and update the related expense or revenue account.

Q:

The _____________________ form of balance sheet lists the asset accounts on the left side and the liabilities and equity accounts on the right side. The ______________________ form of balance sheet lists items vertically with assets followed by liabilities then equity accounts.

Q:

Prepaid expenses, depreciation, and unearned revenues each reflect transactions where cash is received or paid ______________ a related expense or revenue is recognized.

Q:

Refer to the figure above. From the above adjusted trial balance, prepare an income statement for Martin Sky Taxi Services.

Q:

Nike's net income was $780,000; its net assets were $5,200,000; and its net sales were $9,000,000. Calculate its profit margin ratio.

Q:

The work sheet is a required financial statement.

Q:

Harley-Davidson's current assets are $400 million and its current liabilities are $250 million. Its current ratio is 0.63.

Q:

Another name for temporary accounts is:

A.Real accounts.

B.Contra accounts.

C.Accrued accounts.

D.Balance column accounts.

E.Nominal accounts.

Q:

Reversing entries adjust the accrued assets and accrued liabilities that were created by adjusting entries at the end of the prior accounting period.

Q:

Closing the temporary accounts at the end of each accounting period:

A.Serves to transfer the effects of these accounts to the owner's capital account on the balance sheet.

B.Prepares the withdrawals account for use in the next period.

C.Gives the revenue and expense accounts zero balances.

D.Causes owner's capital to reflect increases from revenues and decreases from expenses and withdrawals.

E.All of these.

Q:

Which of the following groups of accounts are not balance sheet accounts?

A.Assets.

B.Liabilities.

C.Revenues.

D.Equity accounts.

E.All of these are balance sheet accounts.

Q:

Which of the following statements describing the debt ratio is false?

A.It is of use to both internal and external users of accounting information.

B.A relatively high ratio is always desirable.

C.The dividing line for a high and low ratio varies from industry to industry.

D.Many factors such as a company's age, stability, profitability and cash flow influence the determination of what would be interpreted as a high versus a low ratio.

E.The ratio might be used to help determine if a company is capable of increasing its income by obtaining further debt.

Q:

The debt ratio is used:

A.To measure the relation of equity to expenses.

B.To reflect the risk associated with a company's debts.

C.Only by banks when a business applies for a loan.

D.To determine how much debt a firm should pay off.

E.All of these.

Q:

It is not necessary to keep separate accounts for all items of importance for business decisions.

Q:

The four methods of inventory valuation are SIFO, FIFO, LIFO, and average cost.

Q:

______________________ are nonoperating activities that include interest expense, losses from asset disposals, and casualty losses.

Q:

A company purchased $8,750 worth of merchandise, with terms of 2/10, n/30. The invoice was paid within the cash discount period. Accordingly, the company received a cash discount of _______________.