Accounting

Anthropology

Archaeology

Art History

Banking

Biology & Life Science

Business

Business Communication

Business Development

Business Ethics

Business Law

Chemistry

Communication

Computer Science

Counseling

Criminal Law

Curriculum & Instruction

Design

Earth Science

Economic

Education

Engineering

Finance

History & Theory

Humanities

Human Resource

International Business

Investments & Securities

Journalism

Law

Management

Marketing

Medicine

Medicine & Health Science

Nursing

Philosophy

Physic

Psychology

Real Estate

Science

Social Science

Sociology

Special Education

Speech

Visual Arts

Question

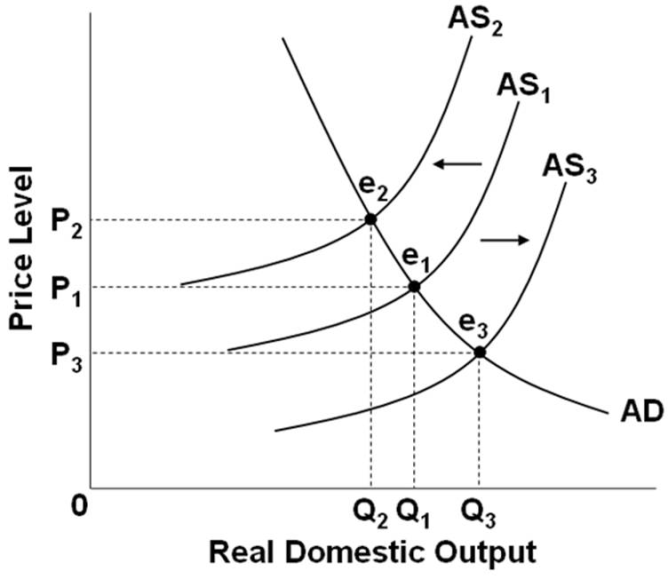

Refer to the above diagram. Cost-push inflation can be illustrated by a:

A. shift in the aggregate supply curve from AS1 to AS2.

B. shift in the aggregate supply curve from AS1 to AS3.

C. shift in the aggregate supply curve from AS2 to AS3.

D. movement along the aggregate demand curve from e1 to e3.

Answer

This answer is hidden. It contains 2 characters.

Related questions

Q:

If the price of product L increases, the demand curve for close-substitute product J will:

A. shift downward toward the horizontal axis.

B. shift to the left.

C. shift to the right.

D. remain unchanged.

Q:

If two goods are complements:

A. they are consumed independently.

B. an increase in the price of one will increase the demand for the other.

C. a decrease in the price of one will increase the demand for the other.

D. they are necessarily inferior goods.

Q:

Which of the following would not shift the demand curve for beef?

A. A widely publicized study that indicates beef increases one's cholesterol

B. A reduction in the price of cattle feed

C. An effective advertising campaign by pork producers

D. A change in the incomes of beef consumers

Q:

Which of the following will not cause the demand for product K to change?

A. A change in the price of close-substitute product J

B. An increase in consumer incomes

C. A change in the price of K

D. A change in consumer tastes

Q:

Drawing demand and supply curves assumes that the primary variable influencing decisions to produce and purchase goods is:

A. price.

B. expectations.

C. preferences.

D. incomes.

Q:

An increase in the price of a product will reduce the amount of it purchased because:

A. supply curves are upsloping.

B. the higher price means that real incomes have risen.

C. consumers will substitute other products for the one whose price has risen.

D. consumers substitute relatively high-priced for relatively low-priced products.

Q:

In presenting the model of a demand curve, economists presume the most important variable in determining the quantity demanded is:

A. the price of the product itself.

B. consumer income.

C. the prices of related goods.

D. consumer tastes.

Q:

Graphically, the market demand curve is:

A. steeper than any individual demand curve that is part of it.

B. greater than the sum of the individual demand curves.

C. the horizontal sum of individual demand curves.

D. the vertical sum of individual demand curves.

Q:

According to the text, what is the largest source of earned income for U.S. households?

A. Wages and salaries.

B. Interest.

C. Proprietors' income.

D. Corporate profits.

Q:

According to the text, U.S. corporations generate approximately what percentage of total sales revenue?

A. 11 percent.

B. 20 percent.

C. 72 percent.

D. 82 percent.

Q:

In the circular economic flow diagram, households:

A. make consumption expenditures and pay for land, labor, and capital.

B. make consumption expenditures and receive goods and services.

C. buy resources and receive goods and services.

D. receive money income and supply resources.

Q:

Refer to the above figure. If box A represents businesses and box D represents the product market in this circular flow model, then money flow in the model would be represented by:

A. (1), (2), (3), and (4).

B. (5), (6), (7), and (8).

C. (1), (3), (6), and (8).

D. (7), (5), (4), and (2).

Q:

Refer to the above figure. If flow (1) is the cost businesses pay to the resource market, then:

A. (2) is the flow of productive resources.

B. (4) is the flow of goods and services.

C. (6) is the flow of money income.

D. (7) is the flow of revenue.

Q:

Refer to the above figure. If box A represents businesses and flow (7) represents goods and services, then:

A. box D is the product market and box B is the resource market.

B. box D is the product market and box B is households.

C. box B is the product market and box C is households.

D. box C is the product market and box B is the resource market.

Q:

Which of the following would be primarily determined in the resource market?A. The price of compact discs.B. The wage rates for electricians.C. The number of automobiles produced.D. The amount of money in circulation.

Q:

Refer to the above table. If demand is represented by columns (3) and (2) and supply is represented by columns (3) and (5), equilibrium price and quantity will be:

A. $10 and 60 units.

B. $9 and 50 units.

C. $8 and 60 units.

D. $7 and 50 units.

Q:

Suppose that corn prices rise significantly. If farmers expect the price of corn to continue rising relative to other crops, then we would expect:

A. the supply of ethanol, a corn-based product, to increase.

B. consumer demand for wheat to fall.

C. the supply to increase as farmers plant more corn.

D. the supply to fall as farmers plant more of other crops.

Q:

An increase in demand means that:

A. given supply, the price of the product will decline.

B. the demand curve has shifted to the right.

C. price has declined and, therefore, consumers want to purchase more of the product.

D. the demand curve has shifted to the left.

Q:

If consumers are willing to pay a higher price than previously for each level of output, we can say that the following has occurred:

A. a decrease in demand.

B. an increase in demand.

C. a decrease in supply.

D. an increase in supply.

Q:

The term "quantity demanded":

A. refers to the entire series of prices and quantities that comprise the demand schedule.

B. refers to a situation in which the income and substitution effects do not apply.

C. refers to the amount of a product that will be purchased at some specific price.

D. means the same thing as demand.

Q:

The quantity demanded of a product increases as its price declines because the:

A. lower price shifts the demand curve rightward.

B. lower price shifts the demand curve leftward.

C. lower price results in an increase in supply.

D. demand curve is downsloping.

Q:

Suppose an excise tax is imposed on product X. We would expect this tax to:

A. increase the demand for complementary good Y and decrease the demand for substitute product Z.

B. decrease the demand for complementary good Y and increase the demand for substitute product Z.

C. increase the demands for both complementary good Y and substitute product Z.

D. decrease the demands for both complementary good Y and substitute product Z.

Q:

A decrease in the price of digital cameras will:

A. cause the demand curve for memory cards to become vertical.

B. shift the demand curve for memory cards to the right.

C. shift the demand curve for memory cards to the left.

D. not affect the demand for memory cards.

Q:

Digital cameras and memory cards are:

A. substitute goods.

B. complementary goods.

C. independent goods.

D. inferior goods.

Q:

If there were a market for pollution rights established by a public agency that determined the amount of pollution that the atmosphere or a body of water can safely absorb, and the agency sold these rights to polluters, we could expect that:

A.the price of these pollution rights would increase over time as the economy grows.

B.there would be a surplus of pollution rights.

C.there would be a shortage of pollution rights.

D.there would be a black market for pollution rights.

Q:

In a market economy with well-defined property rights, the potential threat of a lawsuit or a liability judgment against a firm will give firms an incentive to:

A.decrease negative externalities from production.

B.increase negative externalities from production.

C.increase positive externalities from production.

D.turn to the government to provide public goods.

Q:

One condition for individual bargaining to occur, according to the Coase theorem, is that there must be:

A.clearly defined property rights.

B.many people affected and involved.

C.government intervention to establish bargaining.

D.government creation of a market for externalities.

Q:

Refer to the above supply and demand graph. Point A represents the current equilibrium level of output of this product and point B represents the optimal level of output from society's perspective. If government decides to correct this externality with a subsidy to consumers, then the:

A.demand curve will shift from D2 to D1.

B.supply curve will shift from S1 to S2.

C.demand curve will shift from D1 to D2.

D.supply curve will shift from S2 to S1.

Q:

When producing a good generates negative externalities, the private market for that good tends to produce too:

A.much of the product at too low a price.

B.much of the product at too high a price.

C.little of the product at too low a price.

D.little of the product at too high a price.

Q:

In a free-market economy, a product that entails a spillover benefit will be:

A.overproduced.

B.underproduced.

C.produced at the optimal level.

D.associated only with goods and services provided by the government.