Accounting

Anthropology

Archaeology

Art History

Banking

Biology & Life Science

Business

Business Communication

Business Development

Business Ethics

Business Law

Chemistry

Communication

Computer Science

Counseling

Criminal Law

Curriculum & Instruction

Design

Earth Science

Economic

Education

Engineering

Finance

History & Theory

Humanities

Human Resource

International Business

Investments & Securities

Journalism

Law

Management

Marketing

Medicine

Medicine & Health Science

Nursing

Philosophy

Physic

Psychology

Real Estate

Science

Social Science

Sociology

Special Education

Speech

Visual Arts

Question

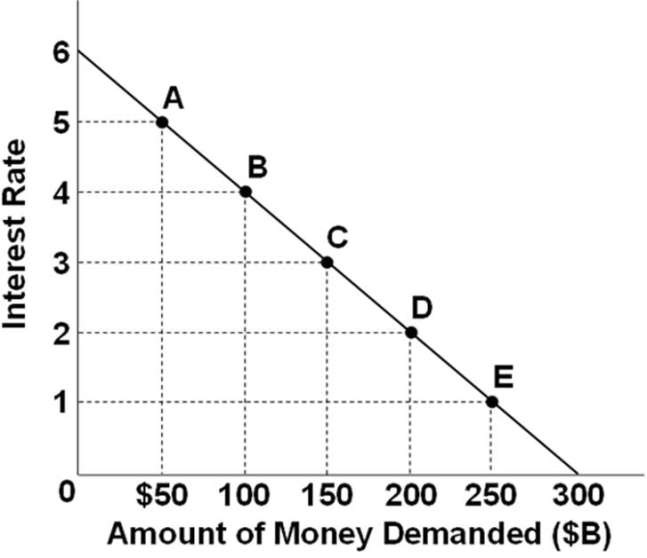

Refer to the above graph. If the interest rate is 2 percent, the supply of money would be:

A. $100 billion.

B. $150 billion.

C. $200 billion.

D. $250 billion.

Answer

This answer is hidden. It contains 2 characters.

Related questions

Q:

In the chain of cause and effect between changes in the excess reserves of commercial banks and the resulting changes in output and employment in the economy:

A. a decrease in aggregate demand will increase output and employment.

B. a decrease in the rate of interest will decrease aggregate demand.

C. an increase in the money supply will decrease the rate of interest.

D. an increase in excess reserves will decrease the money supply.

Q:

Refer to the above graphs, in which the numbers in parentheses near the AD1, AD2, and AD3 labels indicate the level of investment spending associated with each curve, respectively. All numbers are in billions of dollars. The interest rate and the level of investment spending in the economy are at point B on the investment demand curve. To achieve the long-run goal of a noninflationary full-employment output Qfin the economy, the Fed should:

A. decrease the interest rate from 10 to 8 percent.

B. decrease the interest rate from 8 to 6 percent.

C. decrease the interest rate from 6 to 4 percent.

D. increase investment spending from $30 to $60 billion.

Q:

A television report states: "The Federal Reserve will lower the discount rate for the fourth time this year." This report indicates that the Federal Reserve is most likely trying to:

A. reduce inflation.

B. save the banking industry.

C. stimulate the economy.

D. improve the savings rate.

Q:

Lowering the discount rate has the effect of:

A. changing required into excess reserves.

B. changing excess into required reserves.

C. making it less expensive for commercial banks to borrow from the central banks.

D. forcing commercial banks to call in outstanding loans from their best customers.

Q:

Assuming that the Federal Reserve Banks buy $50 million in government securities from commercial banks and the reserve ratio is 25 percent, then the effect will be to:

A. increase the actual supply of money by $50 million.

B. decrease the actual supply of money by $50 million.

C. decrease the potential money supply by $250 million.

D. increase the potential money supply by $250 million.

Q:

Assume that there is a 25 percent reserve ratio and that the Federal Reserve buys $4 billion worth of government securities. If the securities are purchased from the public, this action has the potential to increase bank lending by a maximum of:

A. $4 billion, but only by $1 billion if the securities are purchased directly from commercial banks.

B. $4 billion, but by $16 billion if the securities are purchased directly from commercial banks.

C. $12 billion, and also by $16 billion if the securities are purchased directly from commercial banks.

D. $20 billion, and also by $20 billion if the securities are purchased directly from commercial banks.

Q:

Which of the following is correct?

A. Excess reserves may be found by subtracting actual from required reserves.

B. The supply of money declines when the public purchases securities from commercial banks.

C. Commercial bank reserves are a liability to commercial banks but an asset to Federal Reserve Banks.

D. Commercial banks reduce the supply of money when they "purchase" personal IOUs or government bonds from the public.

Q:

Which increases the excess reserves of commercial banks?

A. The central banks sell bonds to the public.

B. The central banks sell bonds to commercial banks.

C. The central banks buy bonds from commercial banks.

D. The Board of Governors increases the discount rate.

Q:

If the Fed buys government securities from the public in the open market:A. the Fed gives the securities to the public; the public pays for the securities by writing checks that when cleared will increase commercial bank reserves at the Fed.B. the Fed gives the securities to the public; the public pays for them by writing checks that when cleared will decrease commercial bank reserves at the Fed.C. the public gives the securities to the Fed; the Fed pays for the securities by check, which when deposited at commercial banks will increase their reserves at the Fed.D. the public gives the securities to the Fed; the Fed pays for the securities by check, which when deposited at commercial banks will decrease their reserves at the Fed.

Q:

The Federal Reserve alters the amount of the nation's money supply by:

A. reducing the liabilities of the banking system.

B. controlling the assets of the nation's largest banks.

C. minting coins and printing currency that is distributed to banks.

D. manipulating the size of excess reserves held by commercial banks.

Q:

The conduct of monetary policy in the United States is the main responsibility of the:

A. U.S. Treasury.

B. Federal Reserve.

C. Bureau of the Public Debt.

D. Bureau of Economic Analysis.

Q:

Refer to the above graph. If the interest rate was 1 percent and the money supply decreased by $100 billion, the new interest rate would be:

A. 2 percent.

B. 3 percent.

C. 4 percent.

D. 5 percent.

Q:

Refer to the above graph. If the interest rate is 5 percent, the supply of money would be:

A. $50 billion.

B. $100 billion.

C. $150 billion.

D. $200 billion.

Q:

Refer to the above graph. If the supply of money was $150 billion, the interest rate would be:

A. 2 percent.

B. 3 percent.

C. 4 percent.

D. 5 percent.

Q:

Refer to the above graph, which shows the supply and demand for money where Dm1, Dm2, and Dm3 represent different demands for money and Sm1, Sm2, and Sm3 represent different levels of the money supply. The initial equilibrium point is A. What will be the new equilibrium point following an increase in the asset demand for money?

A. C.

B. D.

C. G.

D. I.

Q:

Refer to the above table. Suppose the transactions demand for money is $300 billion and the money supply is $700 billion. A decrease in the money supply to $600 billion would cause the interest rate to:

A. rise to 7 percent.

B. rise to 6 percent.

C. fall to 4 percent.

D. fall to 6 percent.

Q:

Refer to the above table. If the transactions demand for money is $400 billion, an increase in the money supply from $800 billion to $900 billion would cause the equilibrium interest rate to:

A. rise to 7 percent.

B. rise to 6 percent.

C. fall to 4 percent.

D. remain at 5 percent.

Q:

Refer to the above table. Suppose the transactions demand for money is equal to 20 percent of the nominal GDP, the supply of money is $800 billion, and the asset demand for money is that shown in the table. If the nominal GDP is $2000 billion, the equilibrium interest rate is:

A. 4 percent.

B. 5 percent.

C. 6 percent.

D. 7 percent.

Q:

Refer to the above graph, in which Dt is the transactions demand for money, Dm is the total demand for money, and Sm is the supply of money. If the money market is in equilibrium at a 6 percent rate of interest and the supply of money increases to Sm3, then the asset demand for money will have increased by:

A. $75.

B. $125.

C. $200.

D. $325.

Q:

Which line in the above graph would best reflect the slope of the transactions demand for money curve?

A. Line 1.

B. Line 2.

C. Line 3.

D. Line 4.

Q:

Which of the following will generate a demand for country X's currency in the foreign exchange market?

A. Travel by citizens of country X in other countries

B. The desire of foreigners to buy stocks and bonds of firms in country X

C. The imports of country X

D. Charitable contributions by country X's citizens to citizens of developing nations

Q:

The U.S. demand for British pounds is:

A. downsloping because a higher dollar price of pounds means British goods are cheaper to Americans.

B. downsloping because a lower dollar price of pounds means British goods are more expensive to Americans.

C. upsloping because a lower dollar price of pounds means British goods are cheaper to Americans.

D. downsloping because a lower dollar price of pounds means British goods are cheaper to Americans.

Q:

Depreciation of the dollar will:

A. decrease the prices of both U.S. imports and exports.

B. increase the prices of both U.S. imports and exports.

C. decrease the prices of U.S. imports but increase the prices to foreigners of U.S. exports.

D. increase the prices of U.S. imports but decrease the prices to foreigners of U.S. exports.

Q:

The trade deficits of the United States from 1997-2007 were caused by more rapid economic growth in the United States than economic growth in its trading partners.

Q:

The terms of trade will favor a larger nation over a smaller nation.

Q:

Comparative advantage can result from different climates, natural resource endowments, and capital stocks in various countries.

Q:

The principle of comparative advantage is that total output will be greatest when each good is produced by that nation that has the lowest domestic opportunity cost.

Q:

A factor that serves as the economic basis for world trade is the uneven distribution of resources among nations.

Q:

A major goal of the World Trade Organization is to:

A. increase the protection of producers against foreign trade competition.

B. encourage bilateral trade agreements between nations.

C. liberalize international trade among nations.

D. maximize tariff revenue for governments.

Q:

As used in strategic trade policy, tariffs are a variation of the:

A. military self-sufficiency argument for tariffs.

B. increased-domestic-employment argument for tariffs.

C. diversification-for-stability argument for tariffs.

D. infant-industry argument for tariffs.