Accounting

Anthropology

Archaeology

Art History

Banking

Biology & Life Science

Business

Business Communication

Business Development

Business Ethics

Business Law

Chemistry

Communication

Computer Science

Counseling

Criminal Law

Curriculum & Instruction

Design

Earth Science

Economic

Education

Engineering

Finance

History & Theory

Humanities

Human Resource

International Business

Investments & Securities

Journalism

Law

Management

Marketing

Medicine

Medicine & Health Science

Nursing

Philosophy

Physic

Psychology

Real Estate

Science

Social Science

Sociology

Special Education

Speech

Visual Arts

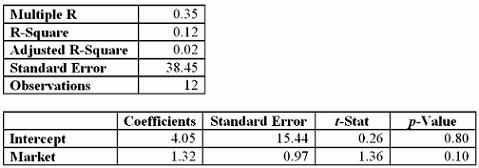

Question

The stock is ______ riskier than the typical stock.

A. 32%

B. 15.44%

C. 12%

D. 38%

Answer

This answer is hidden. It contains 56 characters.

Related questions

Q:

Passive investors with well-diversified international portfolios _________.

A. can safely ignore all political risk in emerging markets

B. can expect very large diversification gains from their international investing

C. do not need to be concerned with hedging exposure to foreign currencies

D. can expect returns to be better than the EAFE on a consistent basis

Q:

Suppose that U.S. equity markets represent about 35% of total global equity markets and that the typical U.S. investor has about 95% of her portfolio invested only in U.S. equities. This is an example of _________.

A. home-country bias

B. excessive diversification

C. active management

D. passive management

Q:

Which one of the following country risks includes the possibility of expropriation of assets, changes in tax policy, and restrictions on foreign exchange transactions?

A. default risk

B. foreign exchange risk

C. market risk

D. political risk

Q:

EAFE stands for _______.

A. Equity and Foreign Exchange

B. Europe, Australasia, Far East

C. Europe, Asian, Foreign Exchange

D. Europe, American, Far East

Q:

What is the proper strategy to capture alpha given the following data? A portfolio generates an annual return of 14%, a beta of 1.5, and the market index returns 12%. The risk free rate is 3%.

A. long the index

B. short the portfolio

C. short the index

D. long the portfolio

Q:

Consider a hedge fund with $200 million at the start of the year. The benchmark S&P 500 Index was up 16.5% during the same period. The gross return on assets is 21%, and the expense ratio is 2%. For each 1% above the benchmark return, the fund managers receive a .1% incentive bonus.

What was the annual return on this fund?

A. 16.5%

B. 18.04%

C. 18.55%

D. 21%

Q:

An example of a neutral pure play is _______.

A. pairs trading

B. statistical arbitrage

C. convergence arbitrage

D. directional strategy

Q:

Hedge funds can invest in various investment options that are not generally available to mutual funds. These include:

I. Futures and options

II. Merger arbitrage

III. Currency contracts

A. I only

B. I and II only

C. I, II, and III only

D. I, II, III, and IV

Q:

A restriction under which investors cannot withdraw their funds for as long as several months or years is called __________.

A. transparency

B. a lock-up period

C. a back-end load

D. convertible arbitrage

Q:

Which of the following typically employ(s) significant amounts of leverage?

I. Hedge funds

II. Equity mutual funds

III. Money market funds

IV. Income mutual funds

A. I only

B. I and II only

C. III and IV only

D. I, II, and III only

Q:

One year U.S. interest rates are 7%, and European interest rates are 5%. The spot euro direct exchange rate quote is 1.30 and the 1-year forward rate direct quote is 1.25. If you can borrow either $1 million or €1 million to start with, what would be your dollar profits from interest arbitrage based on these data?A. $60,384B. $42,973C. $68,422D. $78,500

Q:

WEBS differ from mutual funds in that:

I. WEBS can be shorted.

II. WEBS trade continuously on the AMEX.

III. WEBS are passively managed.

A. II only

B. II and III only

C. I and III only

D. I, II, and III

Q:

The major participants who directly purchase securities in the capital markets of other countries are predominantly ____________.

A. large institutional investors

B. individual investors

C. government agencies

D. central banks

Q:

In the PRS financial risk ratings, the United States rates poorly because of the U.S. ________.

I. Large budget deficit

II. Large trade deficit

III. Large amount of total debt

A. I only

B. I and II only

C. I and III only

D. I, II, and III

Q:

The yen-per-dollar spot rate is 104. The yen-per-dollar forward rate is 107. If the U.S. risk-free rate is 2.4%, what is the likely yen risk-free rate?

A. 1.24%

B. 2.35%

C. 3.98%

D. 5.35%

Q:

The risk-free rate in the United States is 4%, and the risk-free rate in Japan is 1.2%. If the spot rate of yen to dollars is 105, what is the likely yen-per-dollar forward rate?

A. 101

B. 102

C. 105

D. 108

Q:

An investor who is hedging a corporate bond portfolio using a T-bond futures contract is said to have _______.

A. an arbitrage

B. a cross-hedge

C. an over hedge

D. a spread hedge

Q:

_____________ are likely to close their positions before the expiration date, while ____________ are likely to make or take delivery.

A. Investors; regulators

B. Hedgers; speculators

C. Speculators; hedgers

D. Regulators; investors

Q:

Synthetic stock positions are commonly used by ______ because of their ______.

A. market timers; lower transaction cost

B. banks; lower risk

C. wealthy investors; tax treatment

D. money market funds; limited exposure

Q:

Which one of the following contracts requires no cash to change hands when initiated?

A. listed put option

B. short futures contract

C. forward contract

D. listed call option

Q:

A corporation will be issuing bonds in 6 months, and the treasurer is concerned about unfavorable interest rate moves in the interim. The best way for her to hedge the risk is to _________________.

A. buy T-bond futures

B. sell T-bond futures

C. buy stock-index futures

D. sell stock-index futures

Q:

The use of leverage is practiced in the futures markets due to the existence of _________.

A. banks

B. brokers

C. clearinghouses

D. margin

Q:

If you expect a stock market downturn, one potential defensive strategy would be to __________.

A. buy stock-index futures

B. sell stock-index futures

C. buy stock-index options

D. sell foreign exchange futures

Q:

The current level of the S&P 500 is 1,250. The dividend yield on the S&P 500 is 3%. The risk-free interest rate is 6%. The futures price quote for a contract on the S&P 500 due to expire 6 months from now should be __________.

A. 1,274.33

B. 1,286.95

C. 1,268.61

D. 1,291.29

Q:

If the S&P 500 Index futures contract is overpriced relative to the spot S&P 500 Index, you should __________.

A. buy all the stocks in the S&P 500 and write put options on the S&P 500 Index

B. sell all the stocks in the S&P 500 and buy call options on S&P 500 Index

C. sell S&P 500 Index futures and buy all the stocks in the S&P 500

D. sell short all the stocks in the S&P 500 and buy S&P 500 Index futures

Q:

An investor would want to __________ to exploit an expected fall in interest rates.

A. sell S&P 500 Index futures

B. sell Treasury-bond futures

C. buy Treasury-bond futures

D. buy wheat futures

Q:

You are currently long in a futures contract. You instruct a broker to enter the short side of a futures contract to close your position. This is called __________.

A. a cross-hedge

B. a reversing trade

C. a speculation

D. marking to market

Q:

Which one of the following exploits differences between actual future prices and their theoretically correct parity values?

A. index arbitrage

B. marking to market

C. reversing trades

D. settlement transactions

Q:

The current stock price of KMW is $27, the risk-free rate of return is 4%, and the standard deviation is 30%. What is the price of a 63-day call option with an exercise price of $25?A.$2.50B.$2.65C.$2.89D.$3.12

Q:

The option smirk in the Black-Scholes option model indicates that __________.

A. implied volatility changes unpredictably as the exercise price rises

B. stock prices may fall by a larger amount than the model assumes

C. stock prices evolve continuously in today's actively traded markets

D. stocks with lower exercise prices are more likely to pay dividends