Accounting

Anthropology

Archaeology

Art History

Banking

Biology & Life Science

Business

Business Communication

Business Development

Business Ethics

Business Law

Chemistry

Communication

Computer Science

Counseling

Criminal Law

Curriculum & Instruction

Design

Earth Science

Economic

Education

Engineering

Finance

History & Theory

Humanities

Human Resource

International Business

Investments & Securities

Journalism

Law

Management

Marketing

Medicine

Medicine & Health Science

Nursing

Philosophy

Physic

Psychology

Real Estate

Science

Social Science

Sociology

Special Education

Speech

Visual Arts

Question

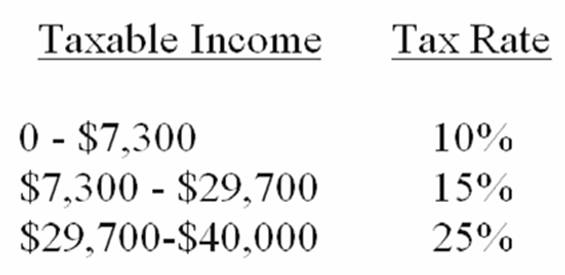

Using the Table below, assume a single person has a taxable income of $40,000.

(a) How much tax will be owed? (You will need to refer to the Table plus make your own calculations).

(b) What is the person's average tax rate?

(c) What is the person's marginal tax rate?

Answer

This answer is hidden. It contains 61 characters.

Related questions

Q:

Least squares trend analysis involves fitting a straight line through a series of data, which, by definition:

A. minimizes the distance of each data point from the line, and minimizes the squared area above and below the trendline.

B. minimizes the distance between each data point.

C. must include at least one peak and at least one trough.

D. must include a minimum of 20 points to get a usable trendline.

Q:

If the Treasury bill rate (RF) increases, then Ke will

A. decrease.

B. increase.

C. stay the same.

D. go up by beta times the Treasury bill rate.

Q:

History shows that, as inflation increases, price-earnings ratios increase along with inflation.

Q:

One basic problem with the application of the Capital Asset Pricing Model when computing Ke is that

A. (Km- RF) is not observable in the market.

B. the analyst needs to forecast dividends for next year.

C. beta is a historical number.

D. the risk-free rate changes every day.

Q:

One way of calculating Ke is to use the Capital Asset Pricing model, as follows:

A. Ke = RF + (KM - RF)

B. Ke = RR + IP + ERP

C. Ke = RF + b(KM - RF)

D. Ke = D1/P0 + g

E. Ke = RF + b(KM)

Q:

Mathematically, the price-earnings ratio (P/E) is simply the price per share divided by earnings per share.

Q:

As inflation increases, the required rate of return on common stocks falls, as well as the prices.

Q:

Valuation models using average price ratios and 10-year averages can be more useful with cyclical companies, because valuation of cyclical companies benefits from an analysis of longer time periods including at least one business cycle.

Q:

Inflation has an indirect effect on price-earnings ratios through its impact on Ke.

Q:

With the income-statement method of forecasting earnings per share (EPS), you start with a forecast of profits.

Q:

In the formula P0 = D1/(Ke - g), one limiting factor is that Ke must always be smaller than g.

Q:

The combined earnings and dividend model considers the present value of dividends, plus the present value of a future P/E ratio times future projected earnings.

Q:

The first step in using the income-statement method of estimating earnings per share (EPS) is to develop an accurate sales forecast.

Q:

Least squares trend analysis is the only method of obtaining a completely objective estimate of future earnings per share.

Q:

Investors who follow the bottom-up approach to stock valuation are referred to as industry-analysts.

Q:

The method that starts the stock valuation process with an economic analysis is called the top-down approach.

Q:

The method of starting the stock valuation process with an analysis of the economy is referred to as the bottom-up approach.

Q:

The first step in the top-down approach to stock valuation is analyzing the position of the industry in its life cycle.

Q:

The crossover point on the life cycle curve is the point where:

A.the company issues stock in an initial public offering (IPO).

B.the company gets listed on an organized exchange.

C.the company's industry moves from the growth stage to the expansion stage.

D.the industry's products begin to be accepted by the marketplace.

E.the company goes into decline, and can no longer compete within the industry.

Q:

Which of the following characteristics is not usually found in industries that are oligopolies?

A.Barriers to entry

B.Intense competition between competitors

C.Increasing foreign competition

D.No differentiation between products

Q:

Which of the following factors would not affect an industry's life cycle?

A.Economic growth

B.Availability of resources

C.Competition

D.Expansion into global markets

Q:

Why do industries usually enter the decline stage?

A.Product innovation has not increased the product base over the years

B.Low dividend payout ratios have kept spending in research and development down

C.Economic recessions have lowered sales

D.Competition from foreign producers has limited profits

Q:

In which stage in the industry life cycle are companies likely to be privately owned?

A.Development

B.Maturity

C.Decline

D.Expansion

Q:

One way some U.S. companies have increased sales growth is by:

A.expanding into markets overseas.

B.increasing dividend payout ratios.

C.decreasing dividend payout ratios.

D.lowering prices.

Q:

Which of the following is the most significant positive factor in the future profitability of the pharmaceutical industry?

A.Research and development of new drugs

B.Government regulation

C.Generic drugs

D.Patents

Q:

Which of the following industries is a good example of an industry in the maturity stage?

A.The pharmaceutical industry

B.The automobile industry

C.The biotechnology industry

D.The health care industry

Q:

Which of the following is the most significant detriment to the future profitability of the pharmaceutical industry?

A.Government regulation

B.Demographic trends

C.Generic drugs

D.Use of too much debt in their capital structure

Q:

Industries in the maturity stage will have growth rates comparable to which of the following?

A.Equal to the long-term trend in the gross domestic product (GDP)

B.Double the long-term trend in GDP

C.Less than the long-term trend in GDP

D.The growth rate of the consumer price index (CPI)

Q:

The pharmaceutical industry has submitted up to 2,900 drugs per year to the U.S. Food and Drug Administration between 1995 and 2009, and the approval rate is close to:

A.3.3%.

B.8.2%.

C.10%.

D.22.2%.

Q:

A technically innovative firm in a mature industry may provide better growth opportunities than a high-growth industry.