Accounting

Anthropology

Archaeology

Art History

Banking

Biology & Life Science

Business

Business Communication

Business Development

Business Ethics

Business Law

Chemistry

Communication

Computer Science

Counseling

Criminal Law

Curriculum & Instruction

Design

Earth Science

Economic

Education

Engineering

Finance

History & Theory

Humanities

Human Resource

International Business

Investments & Securities

Journalism

Law

Management

Marketing

Medicine

Medicine & Health Science

Nursing

Philosophy

Physic

Psychology

Real Estate

Science

Social Science

Sociology

Special Education

Speech

Visual Arts

Question

You are cautiously bullish on the common stock of the Wildwood Corporation over the next several months. The current price of the stock is $50 per share. You want to establish a bullish money spread to help limit the cost of your option position. You find the following option quotes:

Ignoring commissions, the cost to establish the bull money spread with calls would be _______.

A. $1,050

B. $650

C. $400

D. $400 income rather than cost

Answer

This answer is hidden. It contains 148 characters.

Related questions

Q:

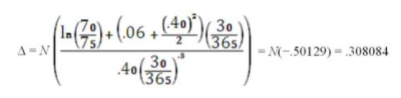

The current stock price of Alcoa is $70, and the stock does not pay dividends. The instantaneous risk-free rate of return is 6%. The instantaneous standard deviation of Alcoa's stock is 40%. You want to purchase a call option on this stock with an exercise price of $75 and an expiration date 30 days from now. Based on the Black-Scholes OPM, the call option's delta will be __________.

A. .28

B. .31

C. .62

D. .70

Q:

Immunization of coupon-paying bonds does not imply that the portfolio manager is inactive because:

I. The portfolio must be rebalanced every time interest rates change.

II. The portfolio must be rebalanced over time even if interest rates don't change.

III. Convexity implies duration-based immunization strategies don't work.

A. I only

B. I and II only

C. II only

D. I, II, and III

Q:

Investors will earn higher rates of returns on TIPS than on equivalent default-risk standard bonds if _______________.

A. inflation is lower than anticipated over the investment period

B. inflation is higher than anticipated over the investment period

C. the U.S. dollar increases in value against the euro

D. the spread between commercial paper and Treasury securities remains low

Q:

The Dow Jones Industrial Average is _________.

A. a price-weighted average

B. a value weight and average

C. an equally weighted average

D. an unweighted average

Q:

Building a zero-investment portfolio will always involve _____________.

A. an unknown mixture of short and long positions

B. only short positions

C. only long positions

D. equal investments in a short and a long position

Q:

Consider the single factor APT. Portfolio A has a beta of .2 and an expected return of 13%. Portfolio B has a beta of .4 and an expected return of 15%. The risk-free rate of return is 10%. If you wanted to take advantage of an arbitrage opportunity, you should take a short position in portfolio __________ and a long position in portfolio _________.

A. A; A

B. A; B

C. B; A

D. B; B

Q:

In a world where the CAPM holds, which one of the following is not a true statement regarding the capital market line?

A. The capital market line always has a positive slope.

B. The capital market line is also called the security market line.

C. The capital market line is the best-attainable capital allocation line.

D. The capital market line is the line from the risk-free rate through the market portfolio.

Q:

What is the term for the process used to assess portfolio manager performance?

A. Active analysis

B. Attribution analysis

C. Passive analysis

D. Treynor-Black Analysis

Q:

A farmer sells futures contracts at a price of $2.75 per bushel. The spot price of corn is $2.55 at contract expiration. The farmer harvested 12,500 bushels of corn and sold futures contracts on 10,000 bushels of corn.

Ignoring the transaction costs, how much did the farmer improve his cash flow by hedging sales with the futures contracts?

A. $0

B. $2,000

C. $31,875

D. $33,875

Q:

A farmer sells futures contracts at a price of $2.75 per bushel. The spot price of corn is $2.55 at contract expiration. The farmer harvested 12,500 bushels of corn and sold futures contracts on 10,000 bushels of corn.

What are the farmer's proceeds from the sale of corn?

A. $27,500

B. $31,875

C. $33,875

D. $35,950

Q:

The use of leverage is practiced in the futures markets due to the existence of _________.

A. banks

B. brokers

C. clearinghouses

D. margin

Q:

The ________ and the _______ have the lowest correlations with the large-cap indexes.

A. Nasdaq Composite; Russell 2000

B. NYSE; DJIA

C. S&P 500; DJIA

D. Russell 2000; S&P 500

Q:

The _________ contract dominates trading in stock-index futures.

A. S&P 500

B. DJIA

C. Nasdaq 100

D. Russell 2000

Q:

When dividend-paying assets are involved, the spot-futures parity relationship can be stated as _________________.

A. F1 = S0(1 + rf)

B. F0 = S0(1 + rf - d)T

C. F0 = S0(1 + rf + d)T

D. F0 = S0(1 + rf)T

Q:

If the S&P 500 Index futures contract is overpriced relative to the spot S&P 500 Index, you should __________.

A. buy all the stocks in the S&P 500 and write put options on the S&P 500 Index

B. sell all the stocks in the S&P 500 and buy call options on S&P 500 Index

C. sell S&P 500 Index futures and buy all the stocks in the S&P 500

D. sell short all the stocks in the S&P 500 and buy S&P 500 Index futures

Q:

Forward contracts _________ traded on an organized exchange, and futures contracts __________ traded on an organized exchange.

A. are; are

B. are; are not

C. are not; are

D. are not; are not

Q:

Which one of the following is a true statement?

A. A margin deposit can be met only by cash.

B. All futures contracts require the same margin deposit.

C. The maintenance margin is the amount of money you post with your broker when you buy or sell a futures contract.

D. The maintenance margin is the value of the margin account below which the holder of a futures contract receives a margin call.

Q:

Margin requirements for futures contracts can be met by ______________.

A. cash only

B. cash or highly marketable securities such as Treasury bills

C. cash or any marketable securities

D. cash or warehouse receipts for an equivalent quantity of the underlying commodity

Q:

The daily settlement of obligations on futures positions is called _____________.

A. a margin call

B. marking to market

C. a variation margin check

D. the initial margin requirement

Q:

In the futures market the short position's loss is ___________ the long position's gain.

A. greater than

B. less than

C. equal to

D. sometimes less than and sometimes greater than

Q:

An investor who goes short in a futures contract will _____ any increase in value of the underlying asset and will _____ any decrease in value in the underlying asset.

A. pay; pay

B. pay; receive

C. receive; pay

D. receive; receive

Q:

The open interest on silver futures at a particular time is the number of __________.

A. all outstanding silver futures contracts

B. long and short silver futures positions counted separately on a particular trading day

C. silver futures contracts traded during the day

D. silver futures contracts traded the previous day

Q:

Which one of the following contracts requires no cash to change hands when initiated?

A. Listed put option

B. Short futures contract

C. Forward contract

D. Listed call option

Q:

Today's futures markets are dominated by trading in _______ contracts.

A. metals

B. agriculture

C. financial

D. commodity

Q:

Hedge ratios for long puts are always __________.

A. between -1 and 0

B. between 0 and 1

C. 1

D. greater than 1

Q:

The option smirk in the Black-Scholes option model indicates that __________.

A. implied volatility changes unpredictably as the exercise price rises

B. stock prices may fall by a larger amount than the model assumes

C. stock prices evolve continuously in today's actively traded markets

D. stocks with lower exercise prices are more likely to pay dividends

Q:

The intrinsic value of an out-of-the-money call option ___________.

A. is negative

B. is positive

C. is zero

D. cannot be determined

Q:

According to the put-call parity theorem, the payoffs associated with ownership of a call option can be replicated by __________________.

A. shorting the underlying stock, borrowing the present value of the exercise price, and writing a put on the same underlying stock and with the same exercise price

B. buying the underlying stock, borrowing the present value of the exercise price, and buying a put on the same underlying stock and with the same exercise price

C. buying the underlying stock, borrowing the present value of the exercise price, and writing a put on the same underlying stock and with the same exercise price

D. shorting the underlying stock, lending the present value of the exercise price, and buying a put on the same underlying stock and with the same exercise price

Q:

The stock price of Ajax Inc. is currently $105. The stock price a year from now will be either $130 or $90 with equal probabilities. The interest rate at which investors can borrow is 10%. Using the binomial OPM, the value of a call option with an exercise price of $110 and an expiration date 1 year from now should be worth __________ today.

A. $11.59

B. $15

C. $20

D. $40

Q:

The current stock price of Alcoa is $70, and the stock does not pay dividends. The instantaneous risk-free rate of return is 6%. The instantaneous standard deviation of Alcoa's stock is 40%. You want to purchase a put option on this stock with an exercise price of $75 and an expiration date 30 days from now. According to the Black-Scholes OPM, you should hold __________ shares of stock per 100 put options to hedge your risk.

A. 30

B. 34

C. 69

D. 74