Accounting

Anthropology

Archaeology

Art History

Banking

Biology & Life Science

Business

Business Communication

Business Development

Business Ethics

Business Law

Chemistry

Communication

Computer Science

Counseling

Criminal Law

Curriculum & Instruction

Design

Earth Science

Economic

Education

Engineering

Finance

History & Theory

Humanities

Human Resource

International Business

Investments & Securities

Journalism

Law

Management

Marketing

Medicine

Medicine & Health Science

Nursing

Philosophy

Physic

Psychology

Real Estate

Science

Social Science

Sociology

Special Education

Speech

Visual Arts

Question

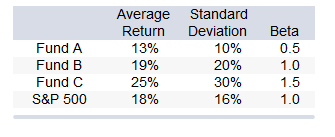

You want to evaluate three mutual funds using the Treynor measure for performance evaluation. The risk-free return during the sample period is 6%. The average returns, standard deviations, and betas for the three funds are given below, in addition to information regarding the S&P 500 Index.

The fund with the highest Treynor measure is

A. Fund A.

B. Fund B.

C. Fund C.

D. Funds A and B (tied for highest).

E. Funds A and C (tied for highest).

Answer

This answer is hidden. It contains 98 characters.

Related questions

Q:

A professional who searches for mispriced securities in specific areas such as merger-target stocks, rather than one who seeks strict (risk-free) arbitrage opportunities is engaged in

A. pure arbitrage.

B. risk arbitrage.

C. option arbitrage.

D. equilibrium arbitrage.

Q:

An important difference between CAPM and APT is

A. CAPM depends on risk-return dominance; APT depends on a no-arbitrage condition.

B. CAPM assumes many small changes are required to bring the market back to equilibrium; APT assumes a few large changes are required to bring the market back to equilibrium.

C. implications for prices derived from CAPM arguments are stronger than prices derived from APT arguments.

D. Both CAPM depends on risk-return dominance; APT depends on a no-arbitrage condition and CAPM assumes many small changes are required to bring the market back to equilibrium; APT assumes a few large changes are required to bring the market back to equilibrium.

E. All of the options are true.

Q:

There are three stocks: A, B, and C. You can either invest in these stocks or short sell them. There are three possible states of nature for economic growth in the upcoming year (each equally likely to occur); economic growth may be strong, moderate, or weak. The returns for the upcoming year on stocks A, B, and C for each of these states of nature are given below: If you invested in an equally-weighted portfolio of stocks A and C, your portfolio return would be ____________ if economic growth was strong.

A. 17.0%

B. 22.5%

C. 30.0%

D. 30.5%

Q:

Consider the one-factor APT. Assume that two portfolios, A and B, are well diversified. The betas of portfolios A and B are 1.0 and 1.5, respectively. The expected returns on portfolios A and B are 19% and 24%, respectively. Assuming no arbitrage opportunities exist, the risk-free rate of return must be

A. 4.0%.

B. 9.0%.

C. 14.0%.

D. 16.5%.

Q:

The ____________ provides an unequivocal statement on the expected return-beta relationship for all assets, whereas the _____________ implies that this relationship holds for all but perhaps a small number of securities.

A. APT; CAPM

B. APT; OPM

C. CAPM; APT

D. CAPM; OPM

Q:

Which pricing model provides no guidance concerning the determination of the risk premium on factor portfolios?

A. The CAPM

B. The multifactor APT

C. Both the CAPM and the multifactor APT

D. Neither the CAPM nor the multifactor APT

E. None of the options are correct.

Q:

In a multifactor APT model, the coefficients on the macro factors are often called

A. systematic risk.

B. factor sensitivities.

C. idiosyncratic risk.

D. factor betas.

E. factor sensitivities and factor betas.

Q:

The capital asset pricing model assumes

A. all investors are price takers.

B. all investors have the same holding period.

C. investors have homogeneous expectations.

D. all investors are price takers and have the same holding period.

E. all investors are price takers, have the same holding period, and have homogeneous expectations.

Q:

Studies of liquidity spreads in security markets have shown that

A. liquid stocks earn higher returns than illiquid stocks.

B. illiquid stocks earn higher returns than liquid stocks.

C. both liquid and illiquid stocks earn the same returns.

D. illiquid stocks are good investments for frequent, short-term traders.

Q:

As a financial analyst, you are tasked with evaluating a capital-budgeting project. You were instructed to use

the IRR method, and you need to determine an appropriate hurdle rate. The risk-free rate is 4%, and the

expected market rate of return is 11%. Your company has a beta of 1.0, and the project that you are evaluating

is considered to have risk equal to the average project that the company has accepted in the past. According to

CAPM, the appropriate hurdle rate would be

A. 4%.

B. 7%.

C. 15%.

D. 11%.

E. 1%.

Q:

Your opinion is that Boeing has an expected rate of return of 0.0952. It has a beta of 0.92. The risk-free rate is

0.04 and the market expected rate of return is 0.10. According to the Capital Asset Pricing Model, this security

Is

A. underpriced.

B. overpriced.

C. fairly priced.

D. Cannot be determined from data provided.

Q:

A security has an expected rate of return of 0.10 and a beta of 1.1. The market expected rate of return is 0.08,

and the risk-free rate is 0.05. The alpha of the stock is

A. 1.7%.

B. 1.7%.

C. 8.3%.

D. 5.5%.

Q:

Empirical results regarding betas estimated from historical data indicate that betas

A. are constant over time.

B. are always greater than one.

C. are always near zero.

D. appear to regress toward one over time.

E. are always positive.

Q:

Consider the following probability distribution for stocks A and B: The coefficient of correlation between A and B is

A. 0.474.

B. 0.612.

C. 0.590.

D. 1.206.

Q:

Given an optimal risky portfolio with expected return of 13%, standard deviation of 26%, and a risk free rate of

5%, what is the slope of the best feasible CAL?

A. 0.60

B. 0.14

C. 0.08

D. 0.36

E. 0.31

Q:

When borrowing and lending at a risk-free rate are allowed, which capital allocation line (CAL) should the

investor choose to combine with the efficient frontier?

I) The one with the highest reward-to-variability ratio.

II) The one that will maximize his utility.

III) The one with the steepest slope.

IV) The one with the lowest slope.

A. I and III

B. I and IV

C. II and IV

D. I only

E. I, II, and III

Q:

The standard deviation of a two-asset portfolio is a linear function of the assets' weights when

A. the assets have a correlation coefficient less than zero.

B. the assets have a correlation coefficient equal to zero.

C. the assets have a correlation coefficient greater than zero.

D. the assets have a correlation coefficient equal to one.

E. the assets have a correlation coefficient less than one.

Q:

In words, the covariance considers the probability of each scenario happening and the interaction between

A. securities' returns relative to their variances.

B. securities' returns relative to their mean returns.

C. securities' returns relative to other securities' returns.

D. the level of return a security has in that scenario and the overall portfolio return.

E. the variance of the security's return in that scenario and the overall portfolio variance.

Q:

The risk that can be diversified away in a portfolio is referred to as ___________.

I) diversifiable risk

II) unique risk

III) systematic risk

IV) firm-specific risk

A. I, III, and IV

B. II, III, and IV

C. III and IV

D. I, II, and IV

E. I, II, III, and IV

Q:

When two risky securities that are positively correlated but not perfectly correlated are held in a portfolio,

A. the portfolio standard deviation will be greater than the weighted average of the individual security standard

deviations.

B. the portfolio standard deviation will be less than the weighted average of the individual security standard

deviations.

C. the portfolio standard deviation will be equal to the weighted average of the individual security standard

deviations.

D. the portfolio standard deviation will always be equal to the securities' covariance.

Q:

Which of the following is not a source of systematic risk?

A. The business cycle

B. Interest rates

C. Personnel changes

D. The inflation rate

E. Exchange rates

Q:

For a two-stock portfolio, what would be the preferred correlation coefficient between the two stocks?

A. +1.00

B. +0.50

C. 0.00

D. 1.00

E. None of the options are correct.

Q:

Which statement about portfolio diversification is correct?

A. Proper diversification can eliminate systematic risk.

B. The risk-reducing benefits of diversification do not occur meaningfully until at least 50-60 individual securities

have been purchased.

C. Because diversification reduces a portfolio's total risk, it necessarily reduces the portfolio's expected return.

D. Typically, as more securities are added to a portfolio, total risk would be expected to decrease at a

decreasing rate.

E. None of the statements are correct.

Q:

The unsystematic risk of a specific security

A. is likely to be higher in an increasing market.

B. results from factors unique to the firm.

C. depends on market volatility.

D. cannot be diversified away.

Q:

Consider two perfectly negatively correlated risky securities A and B. A has an expected rate of return of 10%

and a standard deviation of 16%. B has an expected rate of return of 8% and a standard deviation of 12%.

The risk-free portfolio that can be formed with the two securities will earn a(n) _____ rate of return.

A. 8.5%

B. 9.0%

C. 8.9%

D. 9.9%

Q:

Consider two perfectly negatively correlated risky securities A and B. A has an expected rate of return of 10%

and a standard deviation of 16%. B has an expected rate of return of 8% and a standard deviation of 12%.

The weights of A and B in the global minimum variance portfolio are _____ and _____, respectively.

A. 0.24; 0.76

B. 0.50; 0.50

C. 0.57; 0.43

D. 0.43; 0.57

E. 0.76; 0.24

Q:

Consider the following probability distribution for stocks A and B: The standard deviations of stocks A and B are _____ and _____, respectively.

A. 1.5%; 1.9%

B. 2.5%; 1.1%

C. 3.2%; 2.0%

D. 1.5%; 1.1%

Q:

The variance of a portfolio of risky securities

A. is a weighted sum of the securities' variances.

B. is the sum of the securities' variances.

C. is the weighted sum of the securities' variances and covariances.

D. is the sum of the securities' covariances.

E. None of the options are correct.

Q:

You invest $100 in a risky asset with an expected rate of return of 0.11 and a standard deviation of 0.20 and a

T-bill with a rate of return of 0.03.

What percentages of your money must be invested in the risky asset and the risk-free asset, respectively, to

form a portfolio with an expected return of 0.08?

A. 85% and 15%

B. 75% and 25%

C. 62.5% and 37.5%

D. 57% and 43%

E. Cannot be determined.

Q:

An investor invests 35% of his wealth in a risky asset with an expected rate of return of 0.18 and a variance of

0.10 and 65% in a T-bill that pays 4%. His portfolio's expected return and standard deviation are __________

and __________, respectively.

A. 0.089; 0.111

B. 0.087; 0.063

C. 0.096; 0.126

D. 0.087; 0.144